Category: Budgeting Basics

-

Lifestyle creep: how small upgrades quietly destroy your long-term wealth

Why Lifestyle Creep Is More Dangerous Than It Looks Lifestyle creep — это не резкий скачок расходов, а тихое, почти незаметное раздувание трат после каждого повышения дохода. Новая зарплата приходит, старые привычки кажутся «студенческими», и вдруг базовые вещи уже не устраивают. Проблема в том, что мелкие улучшения — кофе, подписки, апгрейды техники — складываются в…

-

Student loans 101: create a realistic payoff plan as a new grad

Why Your First Student Loan Plan Matters More Than You Think Переход из статуса студента в «взрослую жизнь» в 2025 году почти всегда означает одно: вместе с дипломом вы получаете и внушительный долг. Если отложить разговор о деньгах «на потом», студенческий кредит легко превращается в фоновый стресс на годы. Реалистичный student loan repayment plan for…

-

Beginner’s guide to credit scores: what they are and why they matter

Why Credit Scores Matter More Than You Think Imagine your credit score as a financial passport. It doesn’t just decide if you get a loan; it shapes the price of almost everything, from your mortgage rate to your car insurance and even some job offers. Lenders use this three‑digit number to guess how risky you…

-

How to start an emergency fund while living paycheck to paycheck

Why an Emergency Fund Matters When Every Dollar Is Spoken For When you’re living paycheck to paycheck, an emergency fund can sound like a luxury item, not a realistic goal. But if one surprise bill can derail your entire month, that’s exactly why you need a buffer. Instead of thinking in thousands, think in micro-goals:…

-

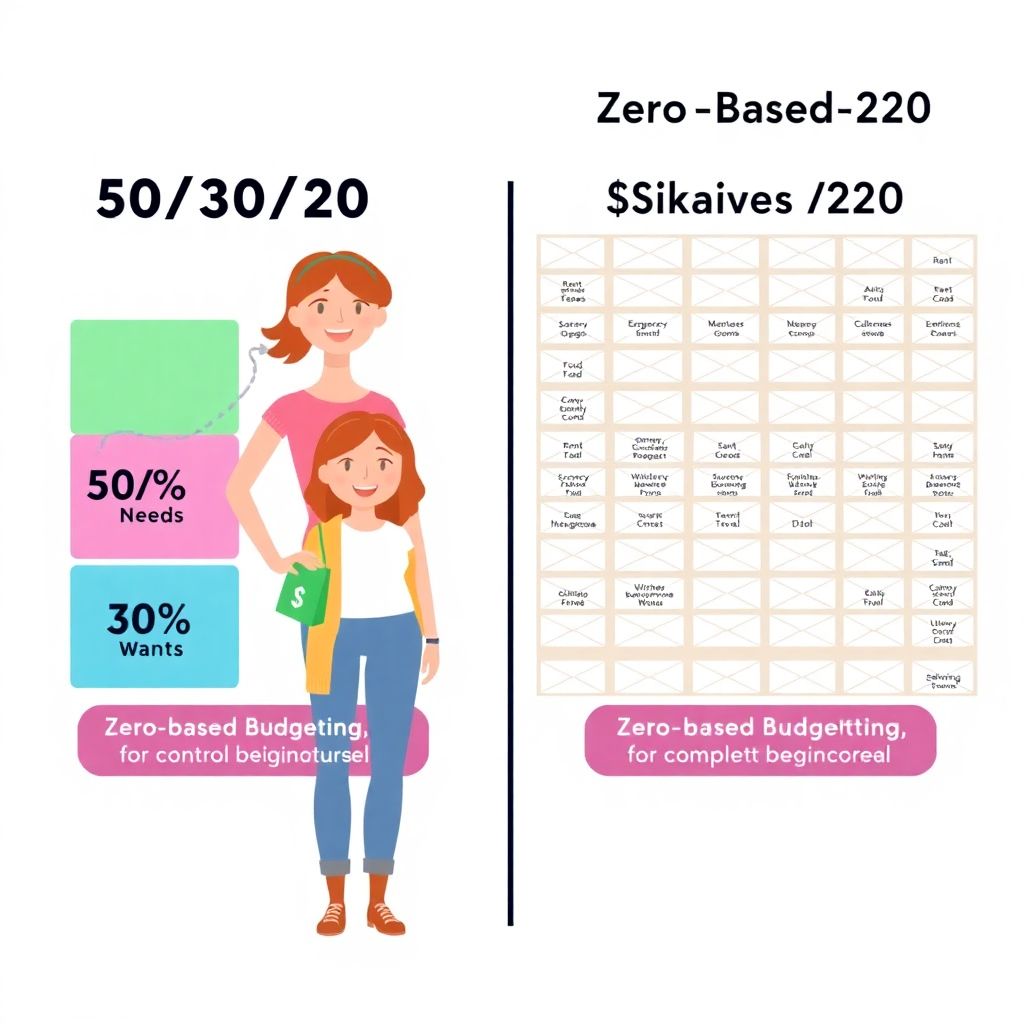

Zero-based budgeting vs 50/30/20 rule: which budgeting method suits beginners

Most people don’t avoid budgeting because they’re lazy. They avoid it because it feels confusing, restrictive, and a bit scary. If that’s you, you’re in the right place. Let’s calmly unpack zero-based budgeting vs 50 30 20 rule and figure out which one actually fits a total beginner’s real life, not some perfect spreadsheet fantasy….

-

Budgeting mistakes beginners make and how to fix them to manage money better

Most people don’t blow their money on something epic; it usually “leaks” по чуть‑чуть: подписки, доставки, рандомные покупки в приложениях. Если ты только начинаешь разбираться с деньгами, важно не просто списать всё на слабую волю, а понять конкретные budgeting mistakes to avoid. Давай разберём пять самых частых ошибок новичков и спокойно посмотрим, как их чинить,…

-

Noobastro market watch: what this month’s financial news means for beginners

NoobAstro Market Watch: Why This Month’s News Matters to Total Beginners This month’s market headlines probably look like a foreign language: rates up, tech down, “soft landing,” “earnings season,” and a dozen scary red arrows. NoobAstro Market Watch is about turning that noise into a simple dashboard so you can see what actually affects your…

-

Investing 101: stocks, bonds and funds explained in simple terms

Why Investing 101 Still Matters in 2025 The money world is huge, but the basics are simple If you feel that finance sounds like another language, you are far from alone. Yet behind all the acronyms and flashy charts, the core of Investing 101 is surprisingly down‑to‑earth: you lend money (bonds), you buy a slice…

-

Beginner’s guide to budgeting and building a personal wealth plan for your future

Why Budgeting Isn’t About Suffering (And What This Guide Will Actually Do) Most “money advice” sounds like: stop buying coffee, suffer for 10 years, maybe retire. That’s useless. A real beginner guide to personal financial planning should объяснить, как встроить деньги в вашу жизнь, а не наоборот. В этой статье разберём, how to create a…

-

Beginner’s guide to budgeting for a more confident and secure financial future

Why budgeting is your secret confidence weapon Let’s be honest: money stress can quietly hijack your mood, your sleep, and even your relationships. A simple, realistic budget flips that script. Instead of wondering “Can I afford this?” you start saying, “I know exactly what I’m doing with my money.” Experts in behavioral finance note that…