Category: Debt Management

-

Buy now, pay later: hidden debt trap every noob must understand

Why “Buy Now, Pay Later” Is Everywhere in 2025 Scroll any online store in 2025 and you’ll see the same banners: “Pay in 4,” “Zero interest,” “Just $10 today.” The idea looks harmless: you grab sneakers, a game console or a new phone, split the bill into pieces and barely feel the hit. That’s the…

-

Saving for multiple goals at once: a beginner’s guide to smart prioritizing

Historical context: from single target saving to portfolio thinking For most of the 20th century, people usually saved “for one big thing”: a home, retirement, or a rainy‑day fund. Bank products were simple, and salaries often followed a predictable trajectory, so parallel goals rarely came up в everyday conversations. With the rise of consumer credit,…

-

Emergency funds made simple: how much you really need and where to keep it

Emergency Funds Made Simple: Why They Matter More Than Ever in 2025 From Gold Coins to High-Yield Apps: Короткая история «подушки безопасности» People have always tried to keep a stash “just in case.” В древности это были мешочки с серебром, спрятанные в доме; в XIX веке — золотые монеты в сундуке. В XX веке роль…

-

How to start investing with just $50: a beginner’s roadmap to growing your money

Why Starting with Just $50 Actually Works Starting to invest with only fifty bucks sounds like a meme, but it’s absolutely viable in 2025. Fractional shares, zero-commission brokers and beginner investment apps with low minimum have killed the old idea that you need thousands to play. The real challenge isn’t the amount of cash, it’s…

-

Debt snowball vs debt avalanche: choose the best strategy to crush debt

Understanding Why Strategy Matters More Than Motivation When you’re staring at a pile of balances, it’s tempting to just “pay more” and hope for the best. The issue is that without a clear system, extra money gets scattered, interest keeps compounding, and progress feels invisible. That’s why choosing the best debt payoff strategy is less…

-

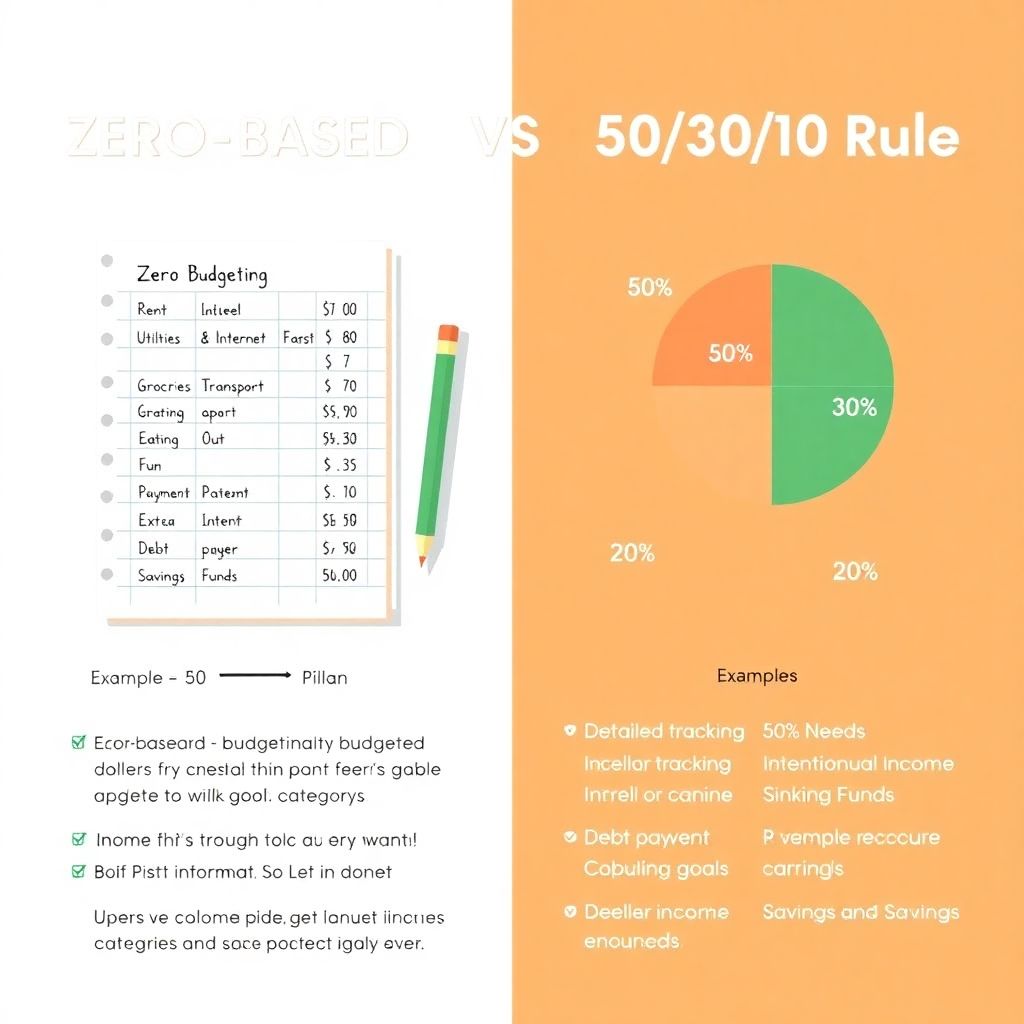

Zero-based vs 50/30/20: choosing the budgeting method that fits your lifestyle

Why these two budgeting methods are everywhere right now If you’ve ever googled “how do I actually start budgeting without going crazy?”, you’ve probably seen the same two systems popping up over and over: zero-based budgeting and the 50/30/20 rule. They both promise control, less money stress, and a clear plan. But they feel very…

-

How to build your first budget step by step for total beginners

Why Your First Budget Matters More Than You Think In 2025 деньги движутся быстрее, чем когда‑либо: подписки списываются автоматически, оплата телефоном занимает секунды, а кредитку достать проще, чем наличные. Именно поэтому budgeting for beginners стал не просто полезным навыком, а базовой финансовой гигиеной, вроде чистки зубов. Бюджет — это не табличка с запретами, а способ…

-

Comfortable life: how to create a cozy, stress-free lifestyle every day

Comfortable Life в 2025: о чём на самом деле речь От «уютно дома» к экосистеме заботы о себе Comfortable Life в 2025 году — это уже не просто мягкий плед и хороший кофе. Это целая экосистема решений вокруг вашего времени, энергии и нервной системы. Мы живём в мире, где есть любые comfortable life products online…

-

Beginner’s guide to budgeting for a bright financial future

Why Budgeting for Beginners Matters More Than Ever Starting a budget isn’t just about “being good with money”; это базовая система управления личной ликвидностью. По данным OECD, домохозяйства, использующие структурированный бюджет, в среднем показывают на 10–15% более высокий уровень сбережений при одинаковом доходе. Для многих новичков budgeting for beginners — это реакция на стресс: кредиты,…

-

Healthy money life: smart habits for financial wellbeing and balanced living

What Is a “Healthy Money Life” Really About? When people hear “Healthy Money Life”, многие сразу думают про строгие бюджеты, тотальный отказ от кофе навынос и бесконечные таблицы в Excel. На деле всё проще и одновременно глубже: это состояние, когда деньги поддерживают вашу жизнь, а не диктуют её. Исследования показывают, что около 60–65% взрослых в…