Most people don’t wake up thinking, “I want to be frugal.” They think, “I’m tired of feeling broke.” Frugal habits for beginners are about exactly that: spending less without feeling like your life has been downgraded to “no fun allowed.”

Below is a technical—but still human—breakdown of how to do it, backed by recent numbers and practical steps you can start this week.

—

What “Frugal” Actually Means (and What It Doesn’t)

Let’s clear up terminology first.

Frugality is the practice of getting maximum value from every unit of money you spend. It’s not the same as being cheap, which is minimizing spending regardless of consequences (like buying the absolute lowest‑quality item that breaks in six months).

In more analytical terms:

– Income = money in (salary, benefits, side gigs).

– Expenses = money out.

– Savings = Income − Expenses (when the result is positive).

– Savings rate = Savings ÷ Income, usually shown as a percentage.

– Frugal habit = any repeated action that lowers expenses *without* reducing your quality of life in a meaningful way.

Over the last three years, frugal behavior has quietly become a survival skill for many households:

– In the U.S., 62–64% of adults reported living paycheck to paycheck between 2022 and mid‑2024, according to multiple LendingClub reports.

– Average credit‑card balances rose from roughly $5,900 in 2022 to about $6,300 in 2023, and crossed $6,500 in 2024 (Federal Reserve and bank industry data).

– Inflation was unusually high in 2022 (~8% average CPI), cooled to about 4% in 2023, and slipped closer to 3–3.5% by mid‑2024, but prices didn’t *fall*—they just rose slower. That means your old budget quietly stopped working.

So the question isn’t “Do I want to be frugal?” It’s “Do I want to keep my options open in a world where everything costs more?”

—

Step 1: Map Your Money Flows

Before you cut anything, you need a clear cash‑flow map: where money enters, where it exits, and what leaks in between. Think of it like debugging code—you don’t delete random lines until you see the error.

Key technical terms here:

– Fixed costs: expenses that don’t change much month to month (rent, insurance, basic internet).

– Variable costs: changeable expenses (groceries, eating out, rideshares, streaming).

– Discretionary costs: the “want” category—non‑essential, but not automatically bad (hobbies, trips, treats).

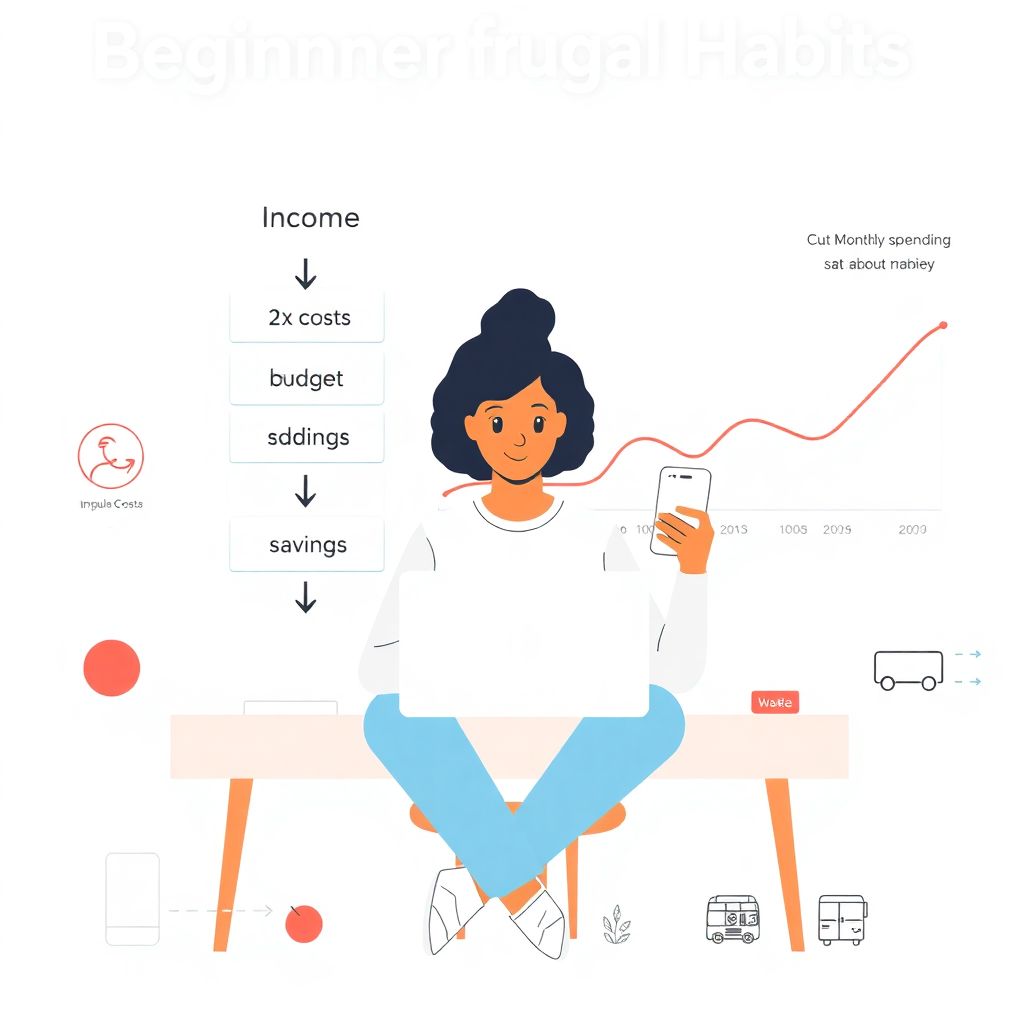

Now imagine a simple diagram:

> Picture a vertical flowchart. At the top is a box labeled “Income.” One arrow goes down to “Fixed Costs,” another to “Variable Costs,” and a third to “Savings & Debt Payments.” Off to the side, smaller arrows labeled “Impulse Buys,” “Fees,” and “Subscriptions” leak away from “Variable Costs” into a box called “Waste.”

That “Waste” box is where beginner frugal habits hit first.

A beginner budgeting plan to stop overspending should be intentionally lightweight so you actually stick to it. A simple structure:

1. Track all spending for 30 days (no judgment yet).

2. Sort into fixed, variable, discretionary.

3. Decide one rule for each category (e.g., “Cap restaurants at $120,” “No new subscriptions this month”).

4. Re‑check after another 30 days and adjust.

If you like tech help, the best budgeting apps to control spending share these traits: automatic transaction import, clear category breakdowns, and simple alerts when you’re close to a limit. Whether you use an app, a spreadsheet, or pen and paper is less important than this: your system must show you, at a glance, where to make the next cut with minimal pain.

—

Step 2: Frugal Habits That Give the Biggest Win

Not all cuts are equal. Some save you pennies and willpower; others save you hundreds with almost no lifestyle cost. You want the latter first.

Economists would call this focusing on high‑elasticity expenses—things that can be changed quickly and easily, like energy usage, food at home vs. takeout, and how you commute.

Here are 5 habit changes, in roughly descending order of potential impact for a typical city dweller:

1. Attack recurring bills, not one‑off treats

A $20 monthly subscription is $240 a year—*forever*—if you let it run. Go through your bank statement and cancel anything you can’t remember using in the last 30 days. This is one of the most overlooked frugal living tips to cut monthly expenses, because it compounds: every canceled subscription gives you a permanent raise.

2. Shrink the grocery bill without eating worse

Between 2022 and 2024, grocery prices in many countries jumped roughly 15–25% cumulatively (OECD and national statistics). You can claw back a big chunk by:

– Writing a basic meal plan before shopping.

– Swapping 2–3 brand‑name items for store brands.

– Cooking one big “base” (rice, pasta, beans, roasted vegetables) for multiple meals.

The habit here is *planning*, not extreme couponing.

3. Re‑engineer transport costs

If you regularly use ride‑hailing, your real hourly “cost of convenience” can be huge. Try this mental model: for each ride, ask, “What would a 10‑minute planning change have done?” (leave earlier, share a ride, combine errands, use transit once or twice a week). A single $15 ride avoided per workday is roughly $300 a month.

4. Turn down the “background” energy spend

Power and heating bills spiked in 2022 and remained elevated in 2023–2024, which is why people are hunting for cheap ways to reduce household bills. Low‑effort tweaks with decent impact:

– LED bulbs everywhere, not just in one room.

– Use power strips and actually switch them off for TV/console setups.

– Wash clothes in cold water; modern detergents are designed for it.

None of these feel dramatic day to day, but together they shave 5–15% off many households’ utility usage.

5. Automate friction, not deprivation

A highly effective frugal habit: the moment your paycheck lands, an automatic transfer moves a tiny, fixed amount to savings or debt. You then “budget” what’s left. This turns savings from an intention into a default.

Notice what’s *not* here: “Never buy coffee again” or “Move into a smaller place immediately.” Start where the numbers say you get the biggest payoff with the least emotional pushback.

—

Step 3: How to Save Money on a Low Income Without Burning Out

Frugal advice can feel tone‑deaf if your income is already very tight. From 2022 to 2024, rent and food costs grew faster than wages for many low‑income workers, and housing studies show over 40% of low‑income renters in the U.S. are cost‑burdened, meaning they spend more than 30% of income on housing alone.

So how to save money on a low income is less about “skip lattes” and more about structural moves and micro‑optimizations combined.

Here’s a three‑layer strategy that respects that reality:

1. Stabilize the essentials first

– Explore eligibility for government or local assistance programs (food benefits, energy credits, rent support). Enrollment rose during and after the pandemic; the systems are there—use them.

– If you can, renegotiate payment plans on existing debt or utilities; many providers quietly offer hardship programs with lower minimums.

2. Apply frugality in “clusters”

Instead of trying to cut everything, pick one spending cluster at a time:

– Food cluster: swap takeout for batch cooking twice a week, buy frozen vegetables, keep a few cheap staple meals on rotation.

– Transport cluster: organize errands to one or two days, share rides, or use public transport passes.

– Phone/internet cluster: look for low‑cost carriers, family plans, or community internet programs.

Focusing on clusters reduces decision fatigue—you’re not saying “no” all day long, just inside one domain at a time.

3. Protect your energy

Extreme frugality can backfire when it leads to burnout and then revenge spending. Give yourself one completely guilt‑free low‑cost pleasure (library books, walks, cheap streaming, meetup events). The goal is sustainability, not temporary austerity.

From a technical standpoint, for low incomes the key metric is your marginal savings rate: how much of each *extra* dollar you manage to keep. Even if you can only save $5–10 a week, building that habit means future income increases are more likely to translate into actual progress instead of lifestyle creep.

—

Comparing Frugality With Other Money Strategies

Frugal living is one tool in the personal‑finance toolbox, not a religion. It’s useful to compare it to some “neighboring” strategies so you don’t mix them up.

– Frugality vs. Minimalism

Minimalism focuses on owning fewer things; frugality focuses on spending less for the same or better value. They often overlap (owning less can mean buying less), but not always. A minimalist might buy one very expensive, high‑quality item; a frugal person might accept mid‑range quality for a better price–performance ratio.

– Frugality vs. FIRE (Financial Independence, Retire Early)

FIRE is a more extreme, mathematically driven version of frugality. It typically involves pushing your savings rate very high (40–60%) to reach a target investment portfolio quickly. For beginners, chasing FIRE‑level cuts too fast can be demotivating. Basic frugality is more concerned with getting from 0% to 10–20% savings reliably.

– Frugality vs. Couponing/Deals‑hunting

Couponing is about price optimization at the checkout line. Frugality is about *system design*: where you live, what you drive, how often you eat out, whether subscriptions renew. In terms of impact, optimizing big recurring choices typically beats hunting for micro‑discounts.

Think of frugality as the baseline operating system for your money. Other strategies are apps that run on top of it.

—

Tracking Progress and Staying Motivated

The easiest way to drift back into overspending is to never see your progress in a concrete way. Numbers may feel abstract, but visualizing them helps.

Imagine this diagram:

> A simple line chart with months on the horizontal axis and two lines on the vertical axis: one shows “Total Monthly Spending,” the other “Savings/Extra Debt Payments.” Over 6–12 months, you want to see the spending line gently slope down or flatten, while the savings line trends upward, even slightly.

To keep it practical, set up a lightweight review routine:

1. Once a week (10–15 minutes)

– Check bank and card balances.

– Scan for weird or forgotten charges (subscriptions, fees).

– Ask: “Is there one small adjustment for next week?”

2. Once a month (30–45 minutes)

– Total your income, total your spending, and compute your savings.

– Compare this month’s savings rate with the last two months.

– Choose one area to improve next month (not five).

3. Every 6–12 months

– Revisit big‑ticket items: housing, transport, insurance.

– Decide if you’re ready for a more ambitious goal (debt payoff, starter investing, skill training).

Frugal habits stick better when there’s a positive narrative attached: “I’m building margin” instead of “I’m not allowed to spend.” Even if you’re just starting with small changes, using some frugal living tips to cut monthly expenses and some cheap ways to reduce household bills consistently over a year can easily free up hundreds or even a few thousand in cash flow—especially given how much costs climbed between 2022 and 2024.

And if you like tech, integrating one or two of the best budgeting apps to control spending into this routine can automate the boring parts, so you can focus on decisions, not data entry.

—

In short, frugal habits for beginners aren’t about living a smaller life—they’re about creating enough financial breathing room that future you has options. Start with a clear map, cut what doesn’t hurt, protect your energy, and treat your budget like an experiment you’re continuously improving rather than a strict diet you’re doomed to break.