Introduction to Monthly Budgeting and Savings

Monthly budgeting is a structured financial process used to allocate income toward essential expenses, discretionary spending, and savings. It serves as a foundational tool for individuals seeking financial stability and long-term wealth accumulation. Savings, in parallel, refers to the portion of income not spent and reserved for future use, emergencies, or investment. Combined, budgeting and savings form the core of personal financial management.

Core Definitions and Terminology

– Income: Total earnings within a given time frame, typically monthly, including salary, freelance payments, dividends, or other sources.

– Fixed Expenses: Recurring monthly costs such as rent, mortgage, insurance premiums, and subscriptions.

– Variable Expenses: Costs that fluctuate monthly, such as groceries, transportation, and utilities.

– Discretionary Spending: Non-essential expenses including entertainment, dining out, and hobbies.

– Emergency Fund: A reserved cash buffer intended for unexpected financial shocks, such as medical emergencies or job loss.

Understanding the distinction between these categories is critical for constructing a resilient budget.

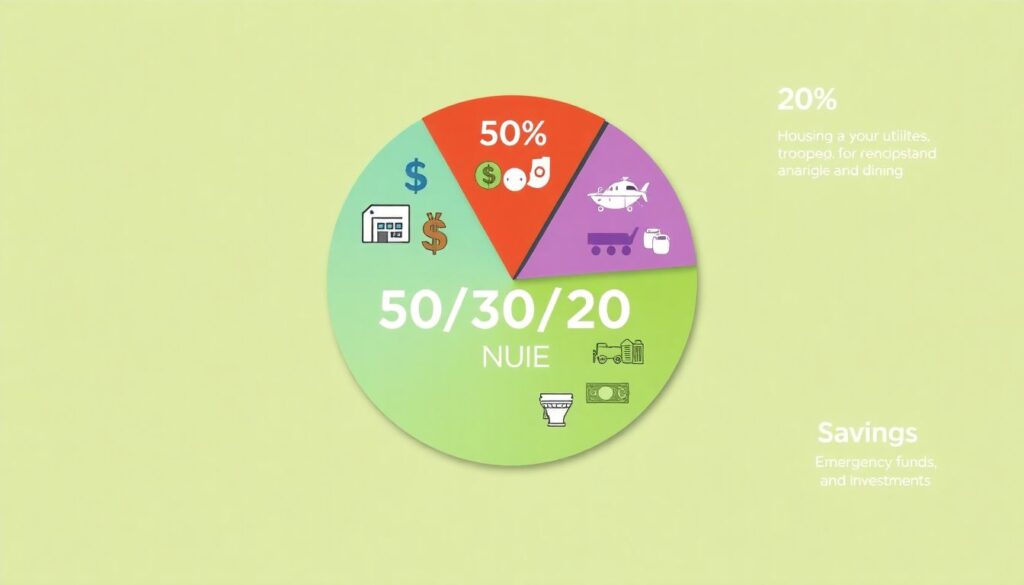

Visualizing the Budgeting Process

Imagine a pie chart divided into three primary sectors:

1. 50%—Needs: Housing, utilities, food, transportation.

2. 30%—Wants: Travel, entertainment, dining.

3. 20%—Savings: Emergency fund, retirement, investments.

This is commonly referred to as the *50/30/20 Rule*, a popular budgeting heuristic. Each segment illustrates proportional prioritization, offering a visual framework for monthly planning.

Step-by-Step Budget Creation

To implement an effective monthly budget, follow these procedural steps:

– Step 1: Income Assessment

– Calculate net monthly income (after-tax).

– Include all reliable revenue sources.

– Step 2: Expense Categorization

– List all fixed and variable expenses.

– Distinguish essential from non-essential spending.

– Step 3: Allocate Funds

– Apply the 50/30/20 rule or a custom ratio based on financial goals.

– Prioritize high-interest debt repayments where applicable.

– Step 4: Track and Adjust

– Use financial apps or spreadsheets to monitor performance.

– Revise allocations monthly based on behavioral trends.

Comparison with Alternative Budgeting Techniques

While the 50/30/20 rule is beginner-friendly, other methodologies offer tailored advantages:

– Zero-Based Budgeting (ZBB): Assigns every dollar a specific purpose, resulting in a monthly balance of zero. Ideal for individuals seeking granular control.

– Envelope System: Uses cash-filled envelopes for expense categories to curb overspending. Useful for those who prefer tangible budgeting.

– Pay-Yourself-First: Prioritizes savings by allocating a fixed percentage of income to savings before addressing expenses.

Compared to the 50/30/20 model, these alternatives require higher discipline and tracking but yield more precise financial control.

Practical Application: Case Example

Consider a software engineer earning $4,000 monthly post-tax. Applying the 50/30/20 rule:

– $2,000 covers rent, utilities, insurance, and groceries.

– $1,200 is allocated to lifestyle spending such as dining, Netflix, and gym memberships.

– $800 is reserved for savings, split into a high-yield savings account and a Roth IRA.

If discretionary expenses exceed $1,200, adjustments must be made to either reduce wants or temporarily lower savings contributions.

Tools and Techniques for Efficiency

To streamline the budgeting and saving process, leverage the following instruments:

– Budgeting applications (e.g., YNAB, Mint, PocketGuard)

– High-yield savings accounts for emergency and short-term goals

– Automated transfers to enforce saving discipline

– Financial dashboards for real-time tracking

These tools enhance visibility and reduce manual errors, increasing adherence to financial goals.

Key Benefits of Structured Budgeting

– Improved Cash Flow Management: Predictable outflows reduce the risk of overdraft or late payments.

– Goal-Oriented Saving: Supports long-term aims such as home ownership or retirement.

– Debt Reduction: Allocates surplus funds for accelerated debt payoff strategies like the avalanche or snowball method.

Common Pitfalls and How to Avoid Them

– Underestimating Variable Expenses: Use historical data to improve forecasting accuracy.

– Neglecting Irregular Costs: Include semi-annual or annual expenses like insurance premiums in monthly planning.

– Lack of Flexibility: Budgets should evolve with income changes or life events.

Conclusion

Monthly budgeting and savings are not static disciplines but dynamic processes that evolve with personal circumstances. By adopting structured methodologies, leveraging digital tools, and maintaining financial discipline, individuals can achieve greater control over their finances, reduce stress, and build a secure future. For beginners, consistency and adaptability are more critical than perfection.