The Origins of Budgeting: From Ancient Ledger Stones to Modern Efficiency

Historical Roots of Budgeting Practices

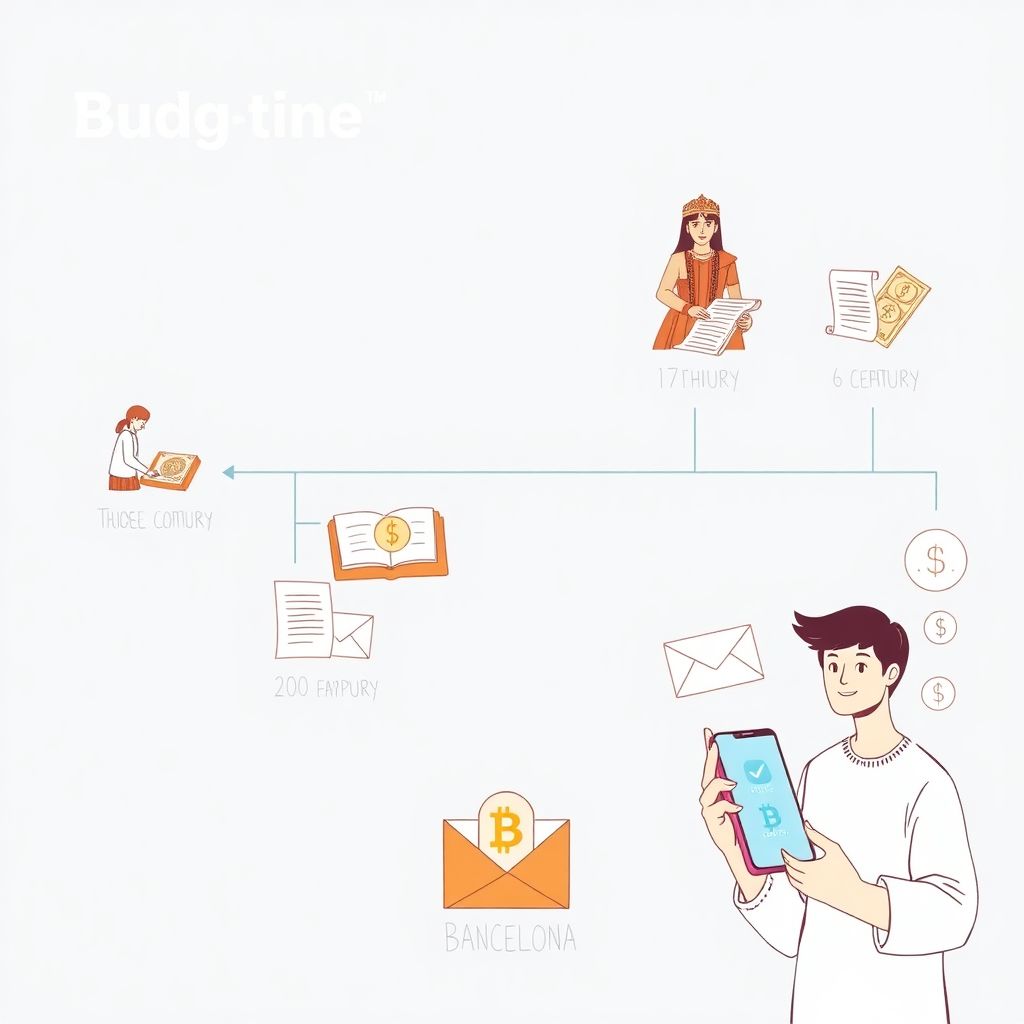

To truly understand the fundamentals of budgeting, it helps to look back. While the term “budget” as we use it today became popular in the 19th century, its conceptual roots trace to antiquity. In Mesopotamia, over 5,000 years ago, Sumerian accountants etched transactional records into clay tablets—early forms of tracking income and expenditure. Fast forward to the 17th century, and European monarchies began adopting formal budgetary systems to manage national expenditures, particularly during times of war. By the 20th century, the need for personal and household budgeting became more apparent as wages became regular, consumer credit expanded, and inflation challenged financial stability. Entering 2025, budgeting has evolved into both a digital and psychological discipline, where behavior and data intersect daily.

Core Principles: What Budgeting Really Is

The Function, Not the Formula

For beginners, budgeting may seem like merely tracking expenses versus income—but that view is reductive. At its core, budgeting is a tool for intentional decision-making. Think of it as a prioritized plan, not a restriction. The most immediate benefit is clarity: understanding where your money goes reveals what you value, often unconsciously. A beginner who sets a goal—say, saving $500 a month—undergoes a shift from reactive to proactive behavior. This mindset shift is a foundational pillar that separates successful planners from those overwhelmed by their cash flow. In practice, the key is not precision, but consistency, as even imperfect budgeting establishes healthy habits over time.

Real-World Examples: Budgeting That Changed Lives

Case Study: From Debt Spiral to Surplus

Consider a 32-year-old freelancer named Elena from Barcelona. In 2022, after COVID-related downturns and a pile-up of short-term loans, she found herself €18,000 in debt. Traditional budgeting apps didn’t help; the categorization overwhelmed rather than guided. Then she tried an envelope-style method—but digitally. She divided her income into custom virtual wallets: necessities, savings, education, and emergencies. In under 18 months, she not only cleared the bulk of her debt but accumulated a three-month emergency fund. Key takeaway: the method matters less than the discipline. Elena personalized her approach by combining visual feedback with automated syncing to her income, demonstrating the adaptive nature of budgeting.

Unconventional Solutions to Common Problems

Psychological Inertia and Financial Automation

A common hurdle for beginners is not overspending, but inertia—taking the first step. Studies in behavioral economics highlight the power of default settings. For instance, automatically transferring 10% of income to a separate “invisible” savings account can boost long-term reserves without mental strain. Also, some beginners falsely believe that budgeting demands daily input. However, the “Set-and-Forget” model—where automation handles recurring expenses and savings—can maintain control with minimal friction. This doesn’t absolve periodic check-ins; rather, it reduces emotional fatigue. Ironically, this passive mode often outperforms active micromanagement among novices.

Alternative Budgeting Methods: Not One Size Fits All

Beyond the 50/30/20 Rule

While the 50/30/20 rule (necessities/wants/savings) remains a popular entry point, it doesn’t suit all financial realities. For example, in high-cost cities like New York or Tokyo, housing alone can consume 60% of net income. Enter the Zero-Based Budget: a method where every dollar or euro is assigned a job. This model works exceptionally well for people with variable income, such as gig workers or artists. Another alternative is the Reverse Budgeting Method, where you prioritize savings goals first—treating savings like a non-negotiable expense—and allocate the remainder to living costs. Experimenting with these models helps beginners find a system that aligns with their psychological profile and economic landscape.

Advanced Hacks for Budgeting Mastery

Behavioral Triggers and Calendar Syncing

Once foundational habits are in place, professionals often lean on subtle yet powerful hacks. One such method is aligning budgeting reviews with natural life rhythms: weekly reviews every Sunday evening or syncing financial tasks with monthly calendar events (rent due dates, paydays). Another technique employs behavioral triggers. For instance, pairing a task you enjoy—like drinking coffee—with a budget check-in trains the brain to associate positivity with financial review. Moreover, leveraging “sinking funds” (special reserves for irregular expenses like holidays or taxes) eliminates the surprise factor, converting irregular stressors into predictable line items. Such refinements separate the financially fluent from the perpetually reactive.

Future Trends: Budgeting in a World of AI and Digital Currencies

From Manual Tools to Predictive Algorithms

In 2025, the rise of AI-powered financial assistants promises to redefine how beginners approach budgeting. Instead of reactive spreadsheets, users now receive predictive insights—such as upcoming subscription renewals they forgot or anomalous spending patterns. Digital wallets tied to blockchain-based currencies also introduce programmable budgeting: your money can auto-divert into categories without human input. Still, the essence remains unchanged—budgeting is a language of priorities told through numbers. As tools become more sophisticated, the need for foundational understanding grows stronger, ensuring AI augments intelligence rather than replaces intention.

Conclusion: From Numbers to Narrative

For beginners, budgeting is not about perfect math but about crafting a compelling story of their financial life. The right questions—Where is my money going? What do I value? What am I preparing for?—transform static budgets into dynamic tools for change. With historical perspective, real-life adaptability, and emerging technology, budgeting becomes more than a ledger; it becomes a map for living with clarity and purpose. The journey begins not with numbers, but with intention.