Why budgeting still matters (even if it sounds boring)

Budgeting has a bad reputation. People imagine spreadsheets, restrictions, and never buying coffee again. In reality, a good budget is just a plan for your money that makes you feel calmer, not trapped. When you’re starting from scratch, the goal isn’t perfection; it’s clarity and control.

Think of it as financial navigation: you can’t reach your destination if you don’t know where you are and where your money is going.

Step 1: Get a quick snapshot of your real numbers

Before you worry about systems or apps, you need a basic picture: what comes in, what goes out, and what’s left.

Start simple:

– List your monthly income (after tax).

– List your fixed expenses (rent, utilities, debt payments, subscriptions).

– Estimate your variable expenses (groceries, transport, eating out, fun).

Then do one tiny but important thing: check the last 1–2 months of bank and card statements to see where your money actually went.

Your memory will usually be kinder than the numbers. The numbers are what matter.

This rough snapshot is enough to move on. Don’t wait until the data is “perfect” — that’s procrastination dressed up as productivity.

Step 2: Choose your budgeting style (comparison of methods)

There’s no single “right” method. Different budgeting approaches work for different personalities. Below are four common methods, with pros, cons, and who they suit best.

The classic “category budget”

You assign specific amounts to categories like rent, groceries, restaurants, fun, savings, and so on. This is the strategy most people imagine when they think about how to start a budget plan.

Pros:

– Very detailed, great for people who like structure.

– Helps you see exactly where money leaks happen.

Cons:

– Takes more time to set up and maintain.

– Some beginners get overwhelmed by too many categories.

Best for: People who like lists, details, and seeing where every dollar goes. If you love color-coded planners, this one will feel natural.

The 50/30/20 rule

This method keeps things broader. Roughly:

– 50% of income → Needs (rent, food, utilities, basic transport)

– 30% → Wants (restaurants, entertainment, hobbies)

– 20% → Savings and debt payoff

You don’t obsess over micro-categories; you just make sure each “bucket” stays within its percentage.

Pros:

– Very beginner-friendly.

– Fast to set up and adjust.

Cons:

– Not detailed enough if your finances are tight or complex.

– The percentages might not fit high-cost cities or irregular incomes.

Best for: People who want guidance without tracking every coffee. A good starting point if you hate the idea of traditional budgets.

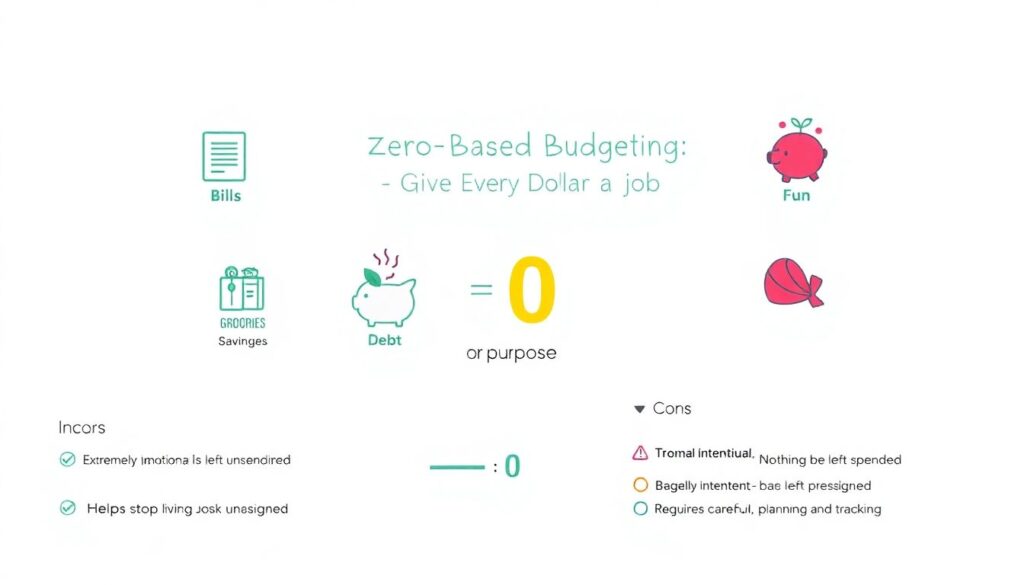

The zero-based budget

With zero-based budgeting, every dollar of income gets a “job”: bills, groceries, savings, debt, fun, all of it. Income minus planned spending equals zero — on purpose.

Pros:

– Extremely intentional; nothing is left unassigned.

– Powerful if you want to stop living paycheck to paycheck.

Cons:

– Requires regular updates and attention.

– Can feel strict or tedious if you dislike details.

Best for: People who want maximum control and are willing to check in often. Great if you’ve got big goals or serious debt and want to move fast.

The “pay yourself first” method

Here you reverse the usual logic. Instead of saving “whatever is left,” you decide your savings and debt goals first, then live on what remains. For example, the moment you’re paid, you send money to savings and loans automatically.

Pros:

– Very effective for building savings with minimal stress.

– Automation reduces the chance of “forgetting” your goals.

Cons:

– Requires a realistic look at your essential expenses.

– If your income is low, the savings target might need frequent tweaking.

Best for: People who don’t want to think about money all the time but still want to make consistent progress.

How to pick the method that fits you

If you want maximum structure and don’t mind effort, try zero-based or a detailed category budget. If you want something light-touch, start with 50/30/20 or pay-yourself-first.

You can also mix approaches. For example, use the 50/30/20 rule as your overall guide, but “pay yourself first” by automating that 20% to savings and debt every payday.

What matters is that you pick one and test it for at least a full month before you judge it.

Step 3: Use tools that match your personality

You don’t need fancy software to budget, but the right tools can reduce friction. Many people search for the best budgeting app for beginners as if there’s one perfect solution. There isn’t — but there are good options for different styles.

Here are the main tool types:

– Pen and paper / notebook – Great if writing things down helps you think. Cheap, no logins, no distractions. Less ideal if you want automatic tracking.

– Spreadsheets – Flexible and powerful once set up. You can customize everything. But they can feel intimidating if you’re not used to them.

– Budgeting apps – These can sync with your accounts, categorize spending, and remind you of bills. They shine for people who want automation and clear visuals.

If you feel lost, start with simple budgeting tools for new budgeters: a basic spreadsheet or a beginner-friendly app that doesn’t overload you with advanced features or jargon.

Step 4: Build a first-draft budget (no perfection allowed)

Now combine your numbers (from Step 1), your chosen style (from Step 2), and your tool (from Step 3).

Let’s keep it practical:

1. Write down your monthly income.

2. List your non‑negotiables: rent, utilities, minimum debt payments, basic food, necessary transport.

3. Decide on a realistic amount for savings or debt payoff, even if it’s tiny.

4. Whatever is left can be split between flexible categories: fun, eating out, shopping, subscriptions, etc.

Your first budget is not a promise to be perfect. It’s a test. You’re just setting a hypothesis: “I think this is where my money will go.” Real life will correct you.

Step 5: Track spending in the simplest possible way

Tracking is where most people give up. They try to log every cent manually and burn out in two weeks. Instead, lower the bar: aim for “good enough,” not forensic accuracy.

Three easy approaches:

– Weekly check‑in: Once a week, check bank and card transactions and roughly categorize them.

– Daily 5‑minute review: Quick glance at your app each evening and tag today’s purchases.

– Cash envelopes for trouble spots: Use physical cash only for categories you tend to overspend (like coffee or eating out). When the envelope is empty, you’re done.

If you dislike tracking, choose a method with more automation: many apps will categorize and track your spending for you, which makes budgeting for beginners course style learning much less painful.

Step 6: Compare “strict” vs “flexible” budgeting

Beginners often ask whether they should be very strict or more relaxed. Both approaches have benefits — and drawbacks.

Strict approach (tight categories, rigid limits)

You plan in detail and try to stick as closely as possible.

– Upside: Rapid progress on goals, especially debt payoff or aggressive saving.

– Downside: High risk of “all‑or‑nothing” thinking — one mistake and you feel like you failed.

Best for short, focused sprints (for example, 3 months to kill a specific debt), not necessarily for life.

Flexible approach (bigger categories, room to adjust)

You keep things broad and allow some movement month to month.

– Upside: Easier to maintain long term, less guilt, more realistic.

– Downside: Progress can be slower if you’re too generous with “wants.”

A workable compromise: be strict with your goals (like savings or debt), and flexible with how you spend your remaining “fun” money.

Step 7: Avoid the most common beginner mistakes

New budgeters tend to fall into the same traps. Watch out for these:

– Underestimating variable expenses. Groceries, transport, and “small” purchases add up. If you’re always over budget here, increase the category instead of pretending it will magically shrink.

– Forgetting irregular costs. Car insurance, gifts, annual subscriptions, medical expenses — they’re not monthly but they are predictable. Divide them by 12 and save that amount each month.

– Changing everything at once. Slashing all fun spending overnight usually leads to rebound overspending. Make 1–2 meaningful changes each month instead of ten.

If you notice a recurring pattern — for example, overspending on weekends — adjust the plan instead of blaming yourself. Your budget should match your real life, not an imaginary version of you.

Step 8: Use technology and support wisely

If you like tech, experiment with a couple of apps and pick the one that feels intuitive, not the one with the most features. The “best” budgeting app for beginners is the one you’ll actually open.

Beyond tools, don’t underestimate human support. Some people benefit a lot from personal finance coaching for beginners, especially if they feel anxious or ashamed about money. A coach or mentor can:

– Help you choose the right method.

– Keep you accountable in the first few months.

– Translate financial jargon into plain language.

If formal coaching is out of reach, a trusted friend, partner, or online community can still keep you motivated.

Step 9: Review monthly and adjust without drama

At the end of each month, do a quick review:

– Did you stay within your total plan, even if categories shifted?

– Which categories were way off?

– What surprised you?

Then, update next month’s budget based on real data. If you always spend more on groceries than you planned, increase that category and adjust elsewhere. This isn’t failure; it’s calibration.

Think of your budget like a draft you’re editing, not a sacred contract carved in stone.

Step 10: Turn budgeting into confidence, not restriction

When budgeting is working, you feel:

– Less panicked checking your bank account.

– More intentional about big decisions (moving, changing jobs, taking a trip).

– Clear about what you can afford without guesswork.

Over time, the system you choose — whether a detailed zero‑based plan, a relaxed 50/30/20 framework, or a simple pay‑yourself‑first setup with automatic transfers and simple budgeting tools for new budgeters — matters less than your consistency.

You don’t need to become a financial expert. You just need a method that fits your personality, tools that make it easier, and a habit of reviewing and adjusting. That combination is what turns “just getting by” into genuine financial confidence.