Historical Context of Personal Budgeting

The concept of personal budgeting has evolved significantly over the past century, transitioning from handwritten ledgers to sophisticated digital platforms. Initially, budgeting was primarily practiced by businesses and households with substantial income. However, with the proliferation of consumer credit in the mid-20th century and the rise of digital banking in the 2000s, personal budgeting became a critical tool for financial survival. From 2022 to 2024, the global economic landscape—marked by inflationary pressures, fluctuating interest rates, and post-pandemic recovery—further emphasized the importance of financial planning. According to a 2024 report by Statista, 61% of U.S. adults reported using some form of budgeting method, up from 52% in 2022. This trend indicates a growing public awareness of financial literacy and the need for structured money management.

Core Principles of Effective Budgeting

Budgeting is fundamentally the process of allocating income toward expenses, savings, and investments in a controlled and intentional manner. The foundational principle is the balance between inflow (net income) and outflow (expenditures). Effective budgeting in 2025 requires adherence to several core concepts:

– Zero-Based Budgeting: Every dollar of income is assigned a specific purpose, ensuring no untracked funds.

– 50/30/20 Rule: A heuristic where 50% of income is allocated to needs, 30% to wants, and 20% to savings or debt repayment.

– Cash Flow Monitoring: Continuous tracking of financial transactions to ensure alignment with the budget.

Additionally, digital tools and AI-based financial advisors have become instrumental. Apps like YNAB (You Need A Budget) and Mint integrate machine learning to offer predictive analytics and spending forecasts, enhancing real-time decision-making.

Practical Implementation Examples

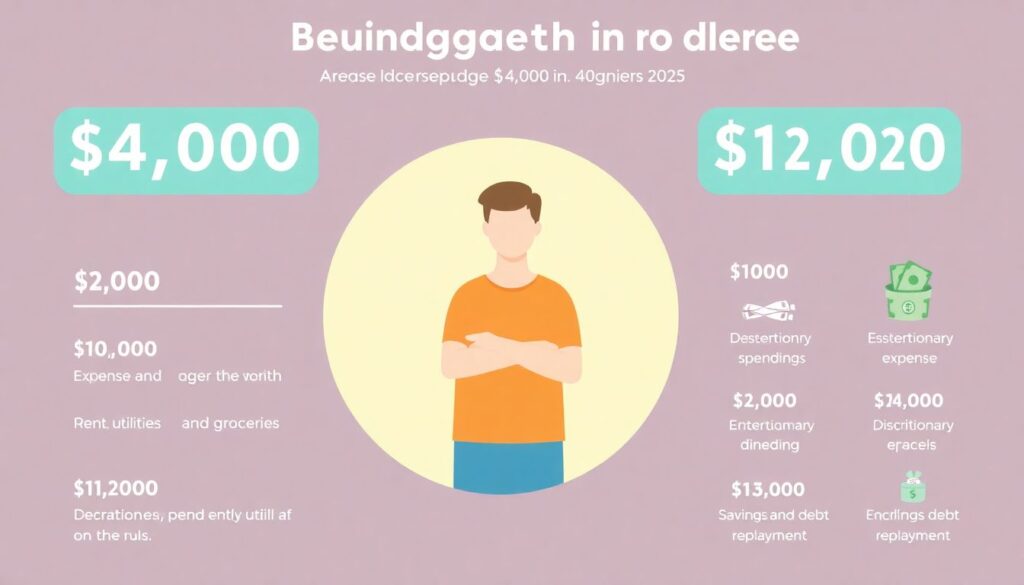

For beginners, implementing a budget in 2025 can be streamlined using a phased approach. Consider the example of a recent college graduate earning $4,000 per month. By applying the 50/30/20 rule:

– $2,000 is allocated to essential expenses (rent, utilities, groceries)

– $1,200 goes to discretionary spending (entertainment, subscriptions)

– $800 is directed toward savings and student loan repayment

To operationalize this, the individual can use envelope budgeting via a digital platform, categorizing transactions and setting dynamic limits. Another case involves a family of four with fluctuating freelance income. By employing a rolling budget that adjusts monthly based on actual income, they can mitigate financial volatility and maintain liquidity.

– Recommended tools for implementation:

– Automated savings triggers (e.g., round-up savings)

– Expense categorization via AI

– Real-time alerts for overspending

Common Misconceptions and Cognitive Biases

Despite increased access to financial tools, several misconceptions hinder effective budgeting. One prevalent myth is that budgeting is only for those with high income or financial problems. In reality, budgeting is a proactive strategy suitable for any income level. Another fallacy is equating budgeting with restriction, whereas it actually enables controlled spending aligned with personal values.

Cognitive biases also play a significant role. The optimism bias leads individuals to underestimate future expenses, while the sunk cost fallacy can cause continued overspending on non-essential commitments. Furthermore, many users confuse net income with gross income, leading to inaccurate budget allocations. According to a 2023 survey by the National Financial Educators Council, 42% of respondents could not correctly define their monthly net income, a critical metric for budgeting accuracy.

– Top budgeting fallacies:

– “I don’t make enough to budget.”

– “Budgets are rigid and eliminate freedom.”

– “Once set, a budget doesn’t need adjustment.”

In conclusion, entering 2025 with a strong budgeting foundation requires understanding its historical relevance, applying proven financial frameworks, leveraging modern tools, and avoiding prevalent misconceptions. As economic conditions remain unpredictable, a robust personal budget is not just a recommendation—it is a necessity for financial resilience.