Why Budgeting a Side Income Feels So Weird (But Matters a Lot)

Side income is sneaky. It shows up irregularly, feels like “extra money,” and disappears faster than your last weekend. That’s why so many people ask themselves how to budget side hustle income without killing the fun or drowning in spreadsheets.

In 2025, more people than ever have at least one side hustle, but most still treat it like a bonus, not part of a real financial system. That’s the gap this guide closes: how to turn your side income into something predictable, purposeful, and actually useful — without going full accountant.

—

Step Zero: Decide What Your Side Income Is *For*

Before tools, apps, and templates, you need intent. Otherwise, your money will find its own job (usually online shopping).

Ask yourself one simple question:

If my side income worked for me perfectly, what would it be doing?

It might be:

1. Paying off debt faster

2. Building an emergency fund

3. Funding investments or retirement

4. Covering “fun money” so your main salary can go to long‑term goals

5. Financing a future career shift or business

Lock in one main purpose. You can change it later, but you need a starting target. Almost all useful side income budgeting tips for beginners start with this clarity, not with fancy tools.

—

Three Main Approaches to Budgeting a Side Income

1. The “Percentages” Approach

You assign fixed percentages of every side hustle payment to different goals.

– 40% to savings/investments

– 30% to debt

– 20% to taxes (if needed)

– 10% to guilt‑free spending

This works extremely well if your income is irregular because the *system* stays stable even when the amounts change.

Short version: every time money hits your account, you already know what to do with it.

—

2. The “Pay Yourself a Salary” Approach

Here you treat your side hustle like a mini‑business.

You separate all side hustle money into a dedicated account. Then once a month, you “pay yourself” a fixed amount from that account into your main spending account. The surplus stays in the side hustle account as a buffer, for taxes, or for reinvestment.

This is a powerful method if your side hustle is growing or fluctuating and you want more predictability in your personal budget.

—

3. The “Goal Buckets” Approach

In this method you create virtual “buckets” (or real separate accounts/spaces) for specific goals:

– “New laptop”

– “Debt payoff”

– “Emergency fund”

– “Courses & skills”

Every time you get paid, you drop specific amounts into these buckets based on current priorities. It’s highly visual and motivating, especially when your goals feel more real than just “savings.”

This approach pairs nicely with a simple budget template for freelancers and side hustlers, because you can see both: where your money *came from* and which bucket it landed in.

—

Comparing These Approaches: What Actually Works in 2025

Flexibility vs. Stability

– Percentages give you flexibility. Ideal when your side income swings wildly month to month. Your goals all move forward together, even if slowly.

– Salary method gives you stability. Your personal budget sees a consistent number, even though the behind‑the‑scenes income is unstable.

– Goal buckets maximize motivation. Great if you’re highly visual and respond to watching lines or balances go up.

In 2025, with so many people juggling gigs and micro‑projects, the most effective real‑world systems often blend these: percentages for overall structure, buckets for visualization, and a pseudo‑salary to your main account.

—

Tech: Pros and Cons of Using Apps, Spreadsheets, and Automation

You can absolutely do this on paper. But since your side hustle likely lives online, your budgeting system probably should too.

Apps: Fast, Connected, but Opinionated

Many people start by searching for the best budgeting apps for side hustle earnings and then get overwhelmed by options. Here’s the trade‑off:

Плюсы (Pros):

– Automatic transaction import from banks and payment platforms

– Easy to tag income by source (Etsy, Upwork, Uber, etc.)

– Built‑in charts that make trends obvious

– Some include tax estimates for self‑employment

Минусы (Cons):

– Subscription costs that eat from the very income you’re trying to control

– Opinionated workflows — the app wants you to budget a certain way

– Data privacy concerns if you’re connecting multiple accounts

– Overkill if your side income is small or occasional

Short comment: apps are most useful when you’ve got recurring side income and several platforms.

—

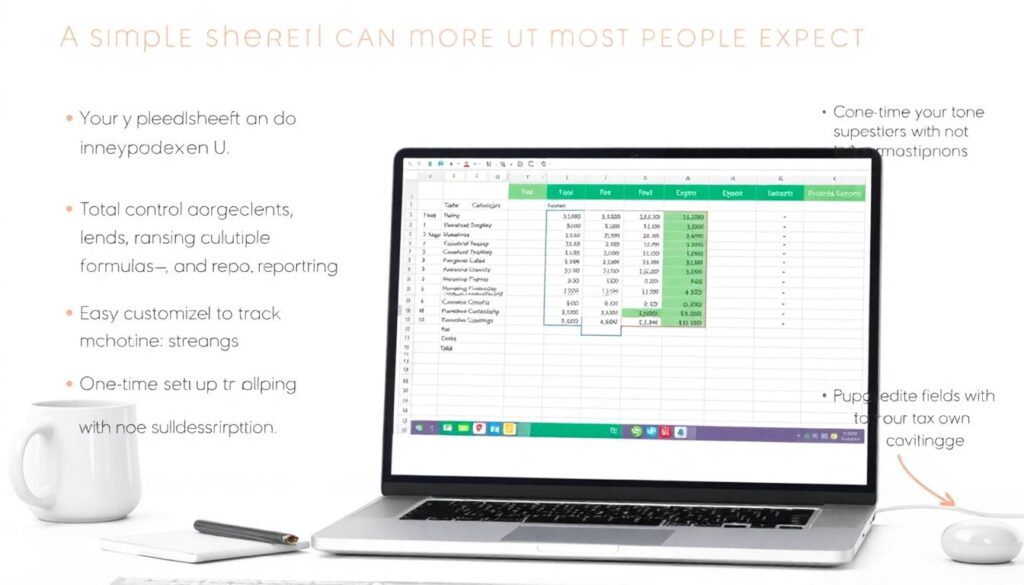

Spreadsheets: Boring Looking, Extremely Adaptable

A simple spreadsheet can do more than most people expect.

Плюсы:

– Total control over categories, formulas, and reporting

– Easy to customize for how to manage and track multiple income streams

– One‑time setup, no subscription needed

– You can plug in your own assumptions (tax rates, savings goals, etc.)

Минусы:

– Manual data entry unless you connect it via imports

– Steeper learning curve if formulas scare you

– No built‑in notifications or “nudges”

– Easy to forget to update if you’re busy

In 2025, a hybrid pattern is common: use an app for automatic imports, export data monthly, and keep your master view in a personal spreadsheet.

—

Bank-Based “Spaces” and Automation

Most modern banks and fintech apps let you create “spaces,” “pots,” or “vaults” within one account. Combined with automation, this can become a quiet, low‑effort engine for your goals.

You can set rules like:

“Whenever more than $X hits this account, move 30% to Taxes, 40% to Savings, 20% to Debt, 10% to Fun.”

This method is especially effective for people who hate budgeting but love progress.

—

How to Actually Start: A Simple 4‑Step System

Below is a straightforward process that balances structure and simplicity. It works even if you’ve never budgeted before.

1. Separate Your Side Income

Open a dedicated account (or sub‑account) for side hustle money.

This psychological separation is huge: you can now see how strong your side income is *without* it blurring into your salary.

—

2. Choose One Core Method (Then Blend Later)

Pick one:

1. Percentages per payment

2. Monthly “salary” from your side hustle

3. Goal buckets

Run it for three months before making major changes. Consistency beats complexity at the beginning.

—

3. Track Sources, Not Just Totals

Don’t just record “Side income: $800.” Break it down:

1. Where did it come from? (Platform/client)

2. How much time did it take?

3. Was it one‑off or repeatable?

This is where a simple sheet shines for how to manage and track multiple income streams intelligently: you’re not just tracking money; you’re tracking what’s *worth your time.*

—

4. Decide a “Default Move” for Every Payment

To avoid decision fatigue, pre‑decide:

– Every time I get paid, I instantly:

1. Move 20–30% to a Tax bucket

2. Apply my percentage formula or bucket amounts

3. Transfer my personal “paycheck” on a fixed date

If you have to invent a process every time money comes in, budgeting will collapse on the first busy week.

—

Technology Choices: Which Tools Fit Which Personality

If You’re Easily Overwhelmed

Use:

– One extra bank account for side income

– A very simple percentages rule

– Basic banking app “spaces” and automatic transfers

Avoid heavy apps and complex spreadsheets at the beginning. Start small, then layer complexity only if you feel limited.

—

If You’re Detail-Oriented

Use:

– A custom spreadsheet with separate tabs for income, expenses, and goals

– An app to pull in transactions (then export monthly)

Here a budget template for freelancers and side hustlers can be a starting point, but customize it to your workflows and platforms. You’re the CFO of your side life; make the system reflect that.

—

If You’re Very Visual and Need Motivation

Lean into:

– Goal buckets with clear names and target amounts

– Apps that show progress bars and “percent to goal”

– Monthly review sessions where you literally see which bucket grew

Seeing your “Future You Fund” or “Debt Demolition” bucket fill up turns budgeting from restriction into progress tracking.

—

Risks and Downsides People Ignore

Even in 2025, the same problems keep repeating.

Tax Shock

Ignoring taxes is the fastest way to regret your side income. Many beginners treat everything that hits their bank as spendable, then panic at tax time.

Build in tax planning from the first dollar:

– Separate 20–35% of net side income depending on your local rules

– Track deductible expenses (software, gear, workspace, etc.)

– Keep invoices and receipts organized by month or client

—

Lifestyle Creep

As your side income grows, your baseline spending tends to quietly rise with it: more takeout, more “tiny” upgrades. Without a conscious plan, your side hustle buys you a slightly nicer version of the same life — not real freedom.

Using a percentage system with fixed goals helps block this: spending doesn’t scale 1:1 with income.

—

Over‑Tooling (Too Many Apps, Too Little Use)

With hundreds of apps specializing in how to budget side hustle income, it’s very easy to sign up for three, use none, and feel weirdly guilty about all of them.

Set a rule for yourself: one main tool for daily/weekly use, one backup (usually a spreadsheet) for monthly review and long‑term records. That’s it.

—

2025 Trends in Side Income Budgeting

The landscape in 2025 is different from even two years ago. A few key shifts:

1. Platform Fragmentation

Many people no longer have “a side hustle.” They have:

– A little affiliate income

– Occasional freelance projects

– Digital product sales

– Local gig work

This makes coherent budgeting more necessary, because income is scattered across dashboards. Tools and guides focused on how to manage and track multiple income streams are getting more popular, and banks are racing to build features for “multi-stream earners.”

—

2. Embedded Tax & Compliance Features

More banking and payment apps now auto‑calculate estimated taxes, show you how much to set aside, and even offer one‑click transfers to a tax vault.

By 2027–2028, expect:

– More real‑time tax suggestions per transaction

– AI-driven alerts when your spending pattern threatens your tax set‑aside

– Region‑specific rule sets baked into mainstream finance apps

Short term, though, you still need a manual plan. Automation is catching up, but not universal yet.

—

3. AI-Assisted Budgeting Becomes Normal

Budgeting tools now quietly use AI to:

– Classify income and expenses more accurately

– Flag unusual patterns (“this client is always late; adjust your cash flow assumptions”)

– Recommend changes (“you’re consistently underusing this account; consolidate”)

Over the next few years, expect personal finance apps to offer more scenario planning:

“If you keep this side hustle for 3 years at current rates, here’s the projected impact on your net worth.”

You’ll still have to choose your goals, but the projections will become far more tailored and practical.

—

4. Templates Get Smarter (But Still Need You)

A generic budget template for freelancers and side hustlers is slowly evolving toward “interactive frameworks” that:

– Ask about your platforms, typical rates, and risk tolerance

– Suggest ranges for tax, savings, and reinvestment percentages

– Auto‑generate a basic budget in under 10 minutes

Forecast: by 2030, the friction of starting will be near zero. The main question won’t be “How do I set this up?” but “Will I stick to what I just set up?” Human discipline will remain the limiting factor.

—

Putting It All Together: A Practical Starting Blueprint

If you want something you can apply this week, here’s a minimal yet robust setup:

1. Open a dedicated side income account (with sub‑spaces if possible).

2. Define one primary purpose for your side income for the next 12 months.

3. Choose a percentages rule (for example):

– 25% Taxes

– 35% Savings/Investments

– 30% Debt or Big Goal

– 10% Fun

4. Automate transfers where your bank/app allows it.

5. Track each income source briefly (client/platform + hours + amount) in a simple sheet.

6. Review monthly:

– Which income streams are most profitable per hour?

– Is your side income still aligned with its main purpose?

– Do you need to adjust percentages?

This system is small, realistic, and designed for 2025 reality — multiple platforms, inconsistent payouts, and limited time.

—

Final Thought: Treat Your Side Income Like a Tool, Not a Tip Jar

Your side hustle is not just “extra cash.” It’s leverage. If you give it even a lightweight budgeting structure, it can pay off years of debt, build serious savings, or quietly fund a career pivot.

Start simple, keep it visible, and let the system evolve with you. The tech will get smarter, the tools will get fancier, but the core stays the same: know what you want your money to do — then give every incoming dollar a job the day it arrives.