Understanding the Basics of Saving

Saving money often sounds like a daunting task, especially when you’re new to personal finance. However, even small modifications in spending habits can lead to significant results over time. Let’s begin with clear definitions to ensure a solid foundation. Saving is the act of setting aside a portion of your income rather than spending it immediately. Budgeting involves planning how your money will be allocated across expenses, savings, and investments. For those seeking budgeting tips for beginners, the essential first step is to track income and expenses for at least one month to identify patterns and leaks.

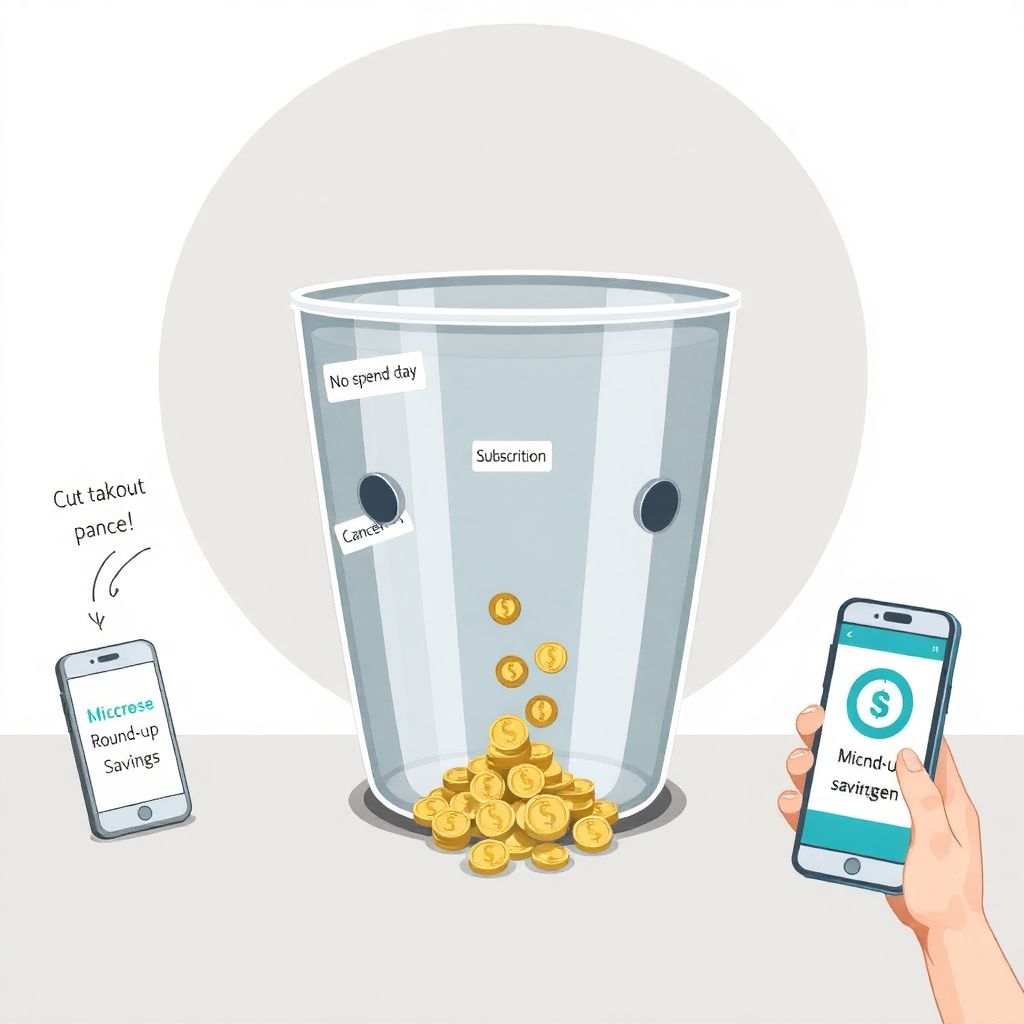

A helpful visual analogy: imagine your finances as a bucket with tiny holes (impulse purchases, unused subscriptions). Even if you keep filling the bucket (earning), it won’t stay full unless you patch the holes (cut unnecessary expenses). This mental model illustrates why paying attention to small expenses is crucial.

Start With Micro-Saving Techniques

Rather than attempting to overhaul your lifestyle overnight, opt for subtle shifts that accumulate over time. Consider these easy ways to save money without sacrificing quality of life:

1. Round-Up Transfers: Activate a feature in your banking app or use a money-saving app for beginners like Qapital or Chime that rounds every purchase to the nearest dollar and transfers the spare change into savings.

2. No-Spend Days: Designate one or two days a week when you intentionally spend nothing. Over a month, this simple habit can save you up to 15% of discretionary spending.

3. Cash-Only Budgeting: Use physical envelopes labeled with categories like “groceries” or “entertainment.” When the cash runs out, spending in that category stops—this technique is surprisingly effective for spenders who tend to lose track digitally.

These strategies may seem minor, but they compound over time, especially when paired with discipline and consistency.

Choosing the Best Savings Vehicles

Once you’ve begun to accumulate funds, the next step is storage—where should your money go? Beginners often default to checking accounts, but these offer little to no interest. Instead, explore the best savings accounts for beginners, which typically include high-yield online savings accounts (HYSA) from banks like Ally or Marcus.

Compared to traditional savings accounts at brick-and-mortar banks, which may offer interest rates as low as 0.01%, HYSAs can offer between 3.50% and 5.00% annual percentage yield (APY). This means your money not only stays safe but grows passively. To visualize the impact: saving $1,000 in a 0.01% APY account earns just $0.10 in a year, whereas a 4.00% account earns $40—400 times more.

Comparison With Investment Accounts

While savings accounts are ideal for short-term goals (emergencies, vacations), many beginners wonder whether to jump directly into investing. Investment accounts offer higher returns but come with risk and volatility. For those still building financial discipline, it’s better to establish a savings buffer first before considering long-term investments.

Automate and Optimize

Automation is a powerful tool for people who struggle with willpower or forgetfulness. By setting up automatic transfers to your savings account the day after each paycheck clears, you’re implementing the “pay yourself first” principle—one of the top budgeting tips for beginners. This method ensures consistent growth without requiring daily decisions.

Another automation method is using subscription management tools—many money-saving apps for beginners like Truebill or Rocket Money scan your bank statements to detect forgotten recurring charges and help cancel them. This not only saves money but also streamlines your monthly budgeting.

Unexpected Ways to Cut Costs

To go beyond common advice, try unconventional approaches:

1. Use the 30-Day Rule: When tempted by an unplanned purchase, wait 30 days. If you still want it, buy it. This reduces impulse buying dramatically.

2. Negotiate Every Contract: Call your internet, phone, or insurance provider and ask for a better rate. You’d be surprised how often companies accommodate to retain customers.

3. Share Subscriptions: Services like Netflix or Spotify often offer family plans that allow multiple users. Coordinate with trusted friends or roommates to split costs legally.

4. Revalue Time Over Money: Instead of defaulting to convenience (e.g., takeout), ask if you could prepare or batch-cook meals ahead. You trade time—but gain control over both nutrition and cost.

Learning to Save Quickly and Sustainably

For those asking how to save money fast, the key is to balance urgency with sustainability. Selling unused items on digital marketplaces, picking up a short-term side hustle, or negotiating a raise can generate lump sums quickly. However, to preserve these gains, it’s essential to pair them with smart budgeting and intelligent saving decisions.

One often-overlooked tactic is identity-based saving. Instead of thinking “I’m someone who needs to save,” shift your mindset to “I am a saver.” This subtle change helps align daily behavior with long-term goals, triggering more consistent financial discipline.

Final Thoughts: Building Wealth Through Small Wins

Developing saving habits is less about drastic sacrifice and more about incremental progress. Through micro-saving, automation, and selective spending, you can unlock impressive results. By leveraging easy ways to save money and choosing the best savings accounts for beginners, even novices can watch their balances grow steadily.

Remember, the journey to financial stability rarely starts with a windfall—it starts with a decision. One small step today could be the foundation of wealth tomorrow.