Why Personal Finance Isn’t Just About Budgeting

When people hear the phrase *”personal finance”*, most immediately think of tracking expenses and cutting out that daily latte. But let’s go deeper. Managing your money is less about restriction and more about direction. If you’re wondering *how to start personal finance* without feeling overwhelmed, you’re not alone. The truth? You don’t need to be an economist or a spreadsheet wizard to take control of your money.

The traditional approach—income minus expenses equals savings—is outdated. Today, there are creative, flexible, and even enjoyable ways to build your financial habits. Let’s compare some of them.

Different Approaches: Finding What Works for You

There’s no one-size-fits-all when it comes to money management. Here are a few popular (and a few unconventional) methods:

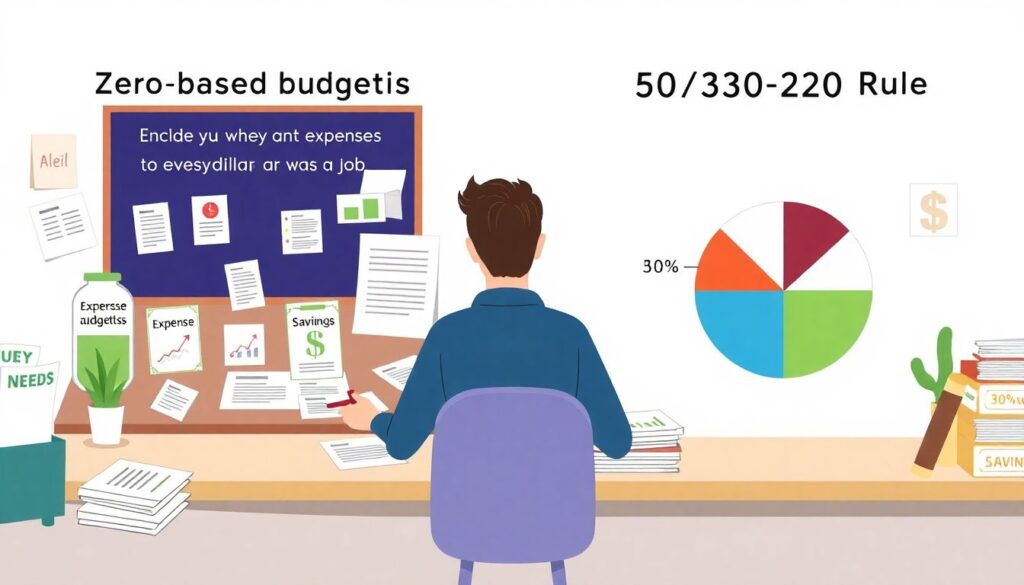

1. Zero-Based Budgeting – Every dollar has a job. Ideal if you love structure.

2. 50/30/20 Rule – Simple and effective. Spend 50% on needs, 30% on wants, 20% on savings.

3. Reverse Budgeting – Save first, spend what’s left. Great for natural spenders.

4. Cash-Only Challenge – Go analog for a month. Yes, actual cash. It’s eye-opening.

5. Value-Based Budgeting – Align your spending with what brings you joy and purpose.

For beginners, the key is to start small. Choose one method and test it for 30 days. That’s it. No need to commit for life—just explore what fits.

Tech Tools: Blessing or Burden?

Modern technology makes personal finance more accessible than ever. But it’s not all sunshine and passive income.

Pros:

– Apps like YNAB, Mint, and Monarch Money are intuitive and packed with features.

– Automation reduces the chance of missing savings or bill payments.

– AI-based tools can analyze your habits and suggest smarter choices.

Cons:

– Too many choices can lead to “app fatigue.”

– Overreliance on automation may make you less aware of your actual spending.

– Privacy concerns—your financial data is valuable.

If you’re just starting out, pick one tool and master it. Don’t chase the next shiny fintech.

How to Choose: A Beginner’s Guide to Personal Finance Tools

With so many options, it’s easy to feel lost. Here’s a simple way to decide what to use:

1. Are you visual? Try a colorful app like PocketGuard.

2. Love spreadsheets? Google Sheets templates are your best friend.

3. Need accountability? Join a personal finance subreddit or Discord group.

4. Hate numbers? Use a values-based planner like Conscious Spending.

Remember, personal finance planning for beginners should feel empowering, not punishing. Choose tools that match your lifestyle—not the other way around.

Fresh Trends in Personal Finance for 2025

The landscape of money is shifting fast. Here are some trends you’ll want to watch this year:

– Micro-investing is becoming mainstream. Apps like Acorns and Stash let you invest spare change.

– AI budgeting assistants are now integrated into banks. Expect proactive notifications like, “You’re spending more on takeout this week.”

– Gamification of savings goals. Platforms now reward you with badges, challenges, and even cashback.

– Digital envelopes are replacing traditional cash methods, allowing you to segment your money digitally.

One surprising newcomer? Financial therapy. More people are seeking help to understand their emotional relationship with money. It’s not just about personal finance basics for beginners anymore—it’s about mindset.

Non-Traditional Tips to Build a Money Mindset

Standard advice like “cut back on coffee” is tired. Here are some unconventional personal finance tips for beginners:

– Create a “joy fund”—a small savings account just for spontaneous fun. This keeps you from resenting your budget.

– Set a “no spend day” challenge once a week. It’s fun and builds awareness.

– Use a visual tracker, like coloring in a savings goal. Sounds childish? It works.

– Talk about money with friends. Even awkward conversations can lead to better habits.

Final Thoughts: Start Where You Are

There’s no perfect starting point—just starting. Whether you’re reading your first beginner’s guide to personal finance or trying to understand compound interest, the most important step is action. Explore different methods, leverage tools mindfully, and don’t be afraid to make it personal.

In 2025, personal finance isn’t just about saving more—it’s about living smarter. And that journey starts today.