Most people don’t really “manage money”; they just react to whatever hits their account. A simple budget flips that script: you decide what money will do before it arrives, instead of guessing later. This isn’t about spreadsheets for perfectionists; it’s about building a clear, flexible picture so you can pay bills on time, get rid of stress, and still have a life. Think of this as a realistic step by step guide to managing money and budgeting, where we’ll mix a conversational tone with a cold, analytical look at the numbers, plus real cases from people who started from zero and managed to turn chaos into something that actually works month after month.

Step 1. Map your money: track reality, not guesses

Before thinking about how to create a simple budget, you need to know what actually happens with your cash right now. For one full month, track every inflow and outflow, without trying to “be good”. Use your banking app exports, receipts, screenshots or a notes app, but focus on honesty, not beauty. Anna, a junior designer, was sure she spent “maybe $80” a month on eating out; real tracking showed $260, mostly from small coffee runs and late-night delivery. That single insight explained why her account hit zero two days before payday. The goal of this phase is diagnostic: discover your spending patterns, typical surprises, and which days of the month are most dangerous.

Step 2. Sort expenses into needs, wants and goals

Once you see the raw data, the next move in budgeting for beginners is categorising instead of judging. Take your tracked month and mark each item as “need” (rent, basic food, utilities, transport, minimum debt payments), “want” (restaurants, streaming, impulse shopping) or “goal” (extra loan payments, savings, investments). Mike, an IT support specialist, thought his problem was “low salary”, but after categorising, he realised that almost 40% of his expenses were wants disguised as needs, like frequent taxis “because it’s late” and premium subscriptions he barely used. This analytical split doesn’t tell you what to cut yet; it simply clarifies how much of your income goes to survival, comfort, and future, so later decisions are based on structure, not guilt.

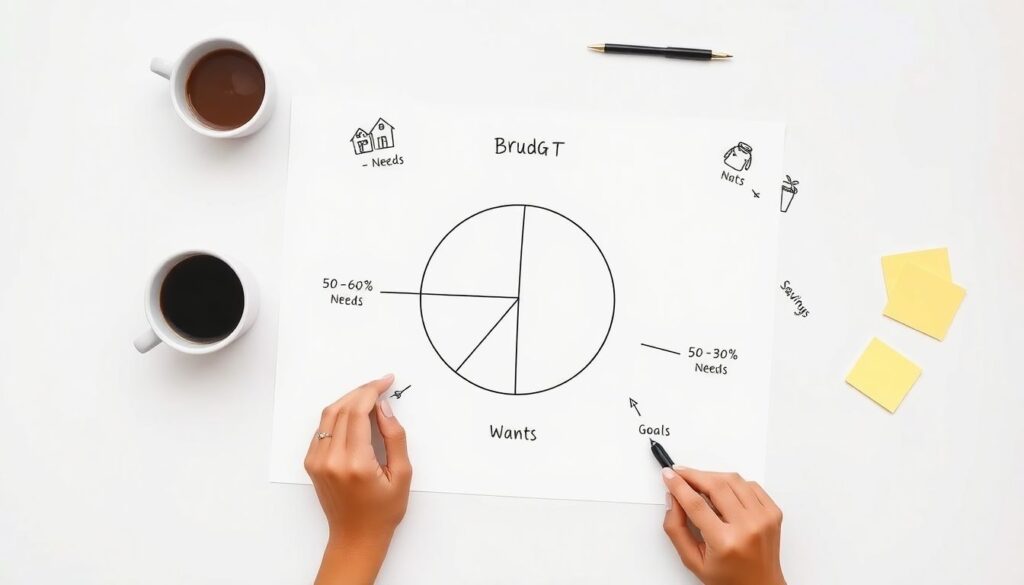

Step 3. Build a first draft budget using simple percentages

Now we transform the picture into a plan. A practical approach for a personal budget planner for beginners is starting with broad percentage targets rather than ultra-detailed line items. For example, you might aim for roughly 50–60% of income on needs, 20–30% on wants and 10–20% on goals, then adapt to your city, debts and income level. Sara, a nurse with irregular night-shift bonuses, set 55% for needs, 25% for wants and 20% for goals; this gave her a clear ceiling for each segment while keeping things flexible when bonuses came in. You don’t need to hit the “perfect” formula immediately; the point is to assign each future dollar a job before you spend it, even if your categories stay fairly broad.

Step 4. Turn percentages into concrete numbers and rules

Percentages are nice in theory, but your bank account lives in real amounts. Convert your targets into numbers based on your average monthly income, then write a few simple behavioural rules. Suppose you earn $2,000 after tax and choose 60% needs, 25% wants, 15% goals. That means $1,200 for needs, $500 for wants and $300 for goals. Anna used this to build two rules: first, all fixed bills plus basic groceries cannot exceed $1,200; second, when her “wants” envelope (a separate debit card) hit zero, she stopped discretionary spending. By converting abstract intentions into numeric caps and simple rules, you reduce decision fatigue during the month and catch overspending early, not when the card is declined.

Step 5. Choose tools: from paper to the best budgeting apps for beginners

Tools won’t save a broken plan, but they do make consistent action easier. On one end, you can use pen and paper or a simple spreadsheet; on the other, there are specialised apps that automate tracking and categorising. For many people, the best budgeting apps for beginners are those that link to bank accounts, send alerts when you’re close to a category limit, and allow quick edits on the go. Mike, who hates spreadsheets, picked an app that rounded all his card payments and sent the difference to savings while also showing colour-coded categories. That tiny automation helped him build an emergency fund without “feeling” the effort. The right tool is the one you’ll actually open twice a week, not the fanciest one.

Step 6. Run a one‑month experiment and adjust aggressively

Treat your first month with a budget as an experiment, not a final exam. Keep a weekly “money check‑in” of ten to fifteen minutes: open your app or spreadsheet, compare real spending to your category caps, and adjust before things get out of hand. Sara discovered in month one that her transport costs were 25% higher than planned because of night shifts and safety concerns, so she cut her entertainment category instead of pretending she’d magically commute cheaper. After three months of experiments and corrections, her budget reflected reality much better than any generic template. The analytical mindset here is to iterate, just like improving a product: observe, tweak, repeat, instead of declaring the whole system a failure after one bad week.

Common beginner mistakes and how to avoid them

New budgeters often fall into predictable traps. One classic mistake is planning an idealised life, not the one you actually live, which leads to unrealistically low categories for groceries, transport or socialising; the result is constant “breaking” of the budget and eventual abandonment. Another error is ignoring annual or irregular expenses such as car insurance, gifts or medical visits; when these hit, people claim the budget “doesn’t work”, though the issue is missing categories. Anna fixed this by listing all non‑monthly costs, estimating yearly totals, and dividing by twelve to create a small monthly “irregular expenses” pot. A third trap is tracking obsessively for two weeks and then burning out; it’s better to set a sustainable routine than chase perfect data that you won’t maintain.

Real‑life progress: three short cases

Let’s tie it together with a few condensed stories. Anna used a very simple setup: one account for bills and needs, one for wants, plus a savings account. Within six months, she went from constant overdrafts to a one‑month emergency buffer and finally felt safe leaving a toxic job. Mike focused on debt; by analysing his categories, he redirected $200 a month from subscriptions and taxis into extra loan payments, cutting his payoff horizon by almost two years. Sara, with her irregular income, built a baseline budget on her minimum guaranteed pay and treated bonuses as “goal‑only” money, which helped her fund a professional course without touching credit. None of them lived perfectly; they simply treated budgeting as a practical system, not a moral scoreboard.

Putting it all together for sustainable money management

If we condense this step by step guide to managing money and budgeting into one principle, it’s about turning vague intentions into numbers plus simple rules, then refining them over time. At its core, budgeting for beginners is less about restriction and more about visibility: you can clearly see what you can afford, what you’re trading off, and how far you are from the goals that matter. A personal budget planner for beginners doesn’t need complex formulas; it needs honest tracking, realistic categories, and a tool you’ll use regularly. With those in place, you get something more valuable than any app feature: calm, confident decisions about money that align with your actual priorities, not just with the pressure of the moment.