Why interest rates suddenly matter to your everyday life

A decade ago, most people barely glanced at central bank announcements. Сash was cheap, mortgages were predictable, and savings accounts paid close to zero. Сince 2022 everything flipped: the Fed, the ECB and other central banks pushed rates up at the fastest pace in forty years to fight inflation. By 2025, policy rates are high by post‑crisis standards, and every move is instantly reflected in loan rates, card APRs and even your bank app. That’s why understanding how interest decisions work is no longer “finance geek” stuff, but basic personal risk management that directly shapes your monthly budget and long‑term plans.

How central banks actually move interest rates

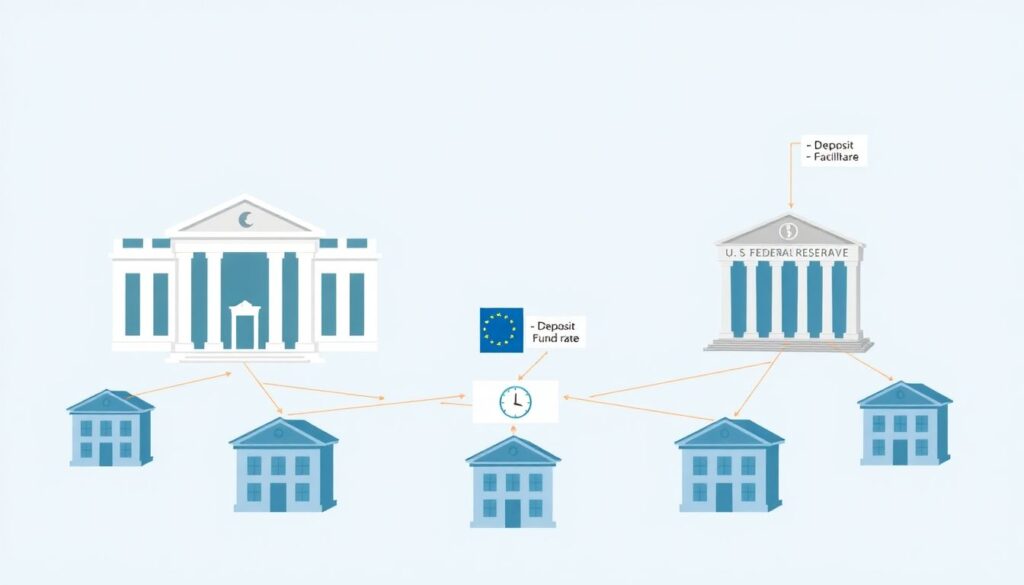

Behind the scenes, central banks don’t dictate every loan rate; they set a short‑term benchmark. The U.S. Federal Reserve targets the federal funds rate, the ECB sets the deposit facility rate, and other authorities manage similar policy rates. Commercial banks lend and borrow around these benchmarks in the interbank market. When the central bank adjusts its target corridor, funding costs for banks shift within days. Those higher or lower costs filter into mortgage rates, auto loans, business credit and savings offers. Markets also price in expected future moves, so bond yields and fixed mortgage offers often react even before official decisions are announced.

Technical detail: the transmission mechanism in plain language

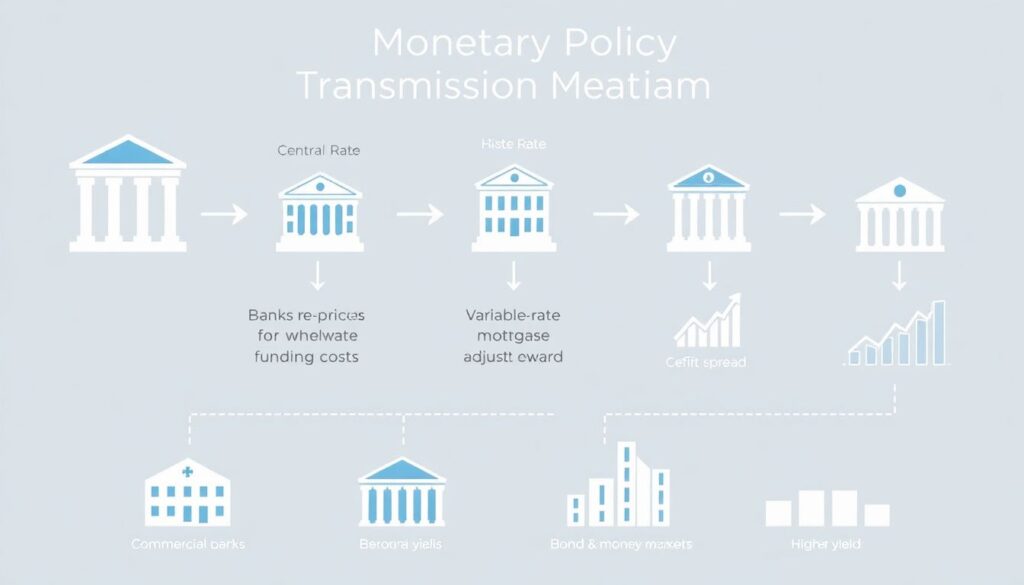

The “monetary policy transmission mechanism” is a chain reaction. A rate hike raises the overnight rate, which increases banks’ wholesale funding costs. Banks then re‑price variable‑rate loans and new fixed‑rate products using benchmarks like SOFR or Euribor, plus a credit spread. Higher yields in bond markets also drag up longer‑term borrowing costs. On the demand side, pricier credit cools consumption and investment, which over time reduces inflation pressure. The reverse happens with cuts. In 2023–2025 regulators are also watching bank balance sheets and liquidity rules, because these can either amplify or dampen the impact of each rate move on the real economy.

Mortgages: the biggest line item on your personal balance sheet

For most households, housing debt is the largest liability, so the question how do central bank interest rate decisions affect my mortgage is not theoretical. If you have an adjustable‑rate mortgage (ARM) linked to a benchmark, central bank hikes usually translate into higher monthly payments at your next reset date. A 2 percentage‑point rise on a $300,000 loan can easily add $300–$400 per month. With fixed‑rate deals, the impact shows up when you buy a new home or when your fixed term ends and you refinance. In high‑rate environments like 2024–2025, many owners delay moving simply to keep their older, cheaper mortgage.

Should you refinance after rate hikes or wait it out?

A lot of owners now ask: should I refinance my home loan after interest rate hike cycles that have already made borrowing expensive? The answer depends on your current rate, remaining term and how markets expect policy to evolve. If you’re on a variable rate that’s already surged and you plan to stay put for years, locking into a slightly lower fixed rate might still reduce risk, even if the headline rate looks high versus the past decade. If markets expect cuts within a year, it can be rational to accept short‑term pain on a floating rate and refinance later. Running scenarios with a broker or online calculator is essential before signing anything.

Technical detail: break‑even analysis for refinancing

A practical way to decide on refinancing is break‑even analysis. You compare: (1) total upfront costs (fees, appraisals, potential prepayment penalties) versus (2) the cumulative interest savings from the new rate over a realistic horizon. Divide costs by monthly savings to get the break‑even in months. If you expect to sell or refinance again before that point, the deal usually doesn’t pay. Also consider term changes: switching from 20 to 30 years may lower the payment but raise total interest, especially if policy rates stay elevated longer than markets currently price in. These technical details matter more than the headline APR alone.

Credit cards: where Fed moves bite the fastest

If you’re wondering how will Fed interest rate changes affect credit card debt, the tough news is: almost immediately. Card APRs are usually tied to the prime rate, which closely tracks the federal funds rate with a fixed margin. When the Fed raised rates repeatedly from near zero to above 5% in 2022–2023, average U.S. credit card APRs climbed above 20%, and many riskier segments now see 25–30%. That means carrying a balance has become dramatically more expensive. In 2025, even small additional hikes can add meaningful interest costs, while cuts offer quick relief to those who aggressively pay down balances.

Best tactics for surviving higher borrowing costs

When policy rates are elevated, the best ways to save money when interest rates rise are surprisingly straightforward but require discipline. Priority one is eliminating high‑APR debt, starting with credit cards and store financing. Next, avoid variable‑rate borrowing for non‑essentials; locking in fixed terms for cars or personal loans caps your exposure to further hikes. Finally, build a liquidity buffer so you’re not forced onto expensive overdrafts when surprises hit. A simple hierarchy helps:

– Pay off the highest‑interest debts first (“debt avalanche”).

– Refinance or consolidate if you can meaningfully cut your effective rate.

– Delay big discretionary purchases that require new borrowing.

Savings accounts: from dead money to real yield

For savers, the shift from zero rates to positive yields is a rare tailwind. After years of negligible returns, how do central bank rate cuts impact savings account returns has become just as important as hikes. In 2023–2025, online banks and money market funds began offering 3–5% in many developed markets when policy rates were elevated, but not all institutions pass through the full benefit. When central banks eventually pivot to cuts, these returns will decline again, often faster than loan rates. That makes it critical to monitor your bank’s responsiveness and be ready to switch providers if your yield lags the broader market by more than about 0.5–1 percentage point.

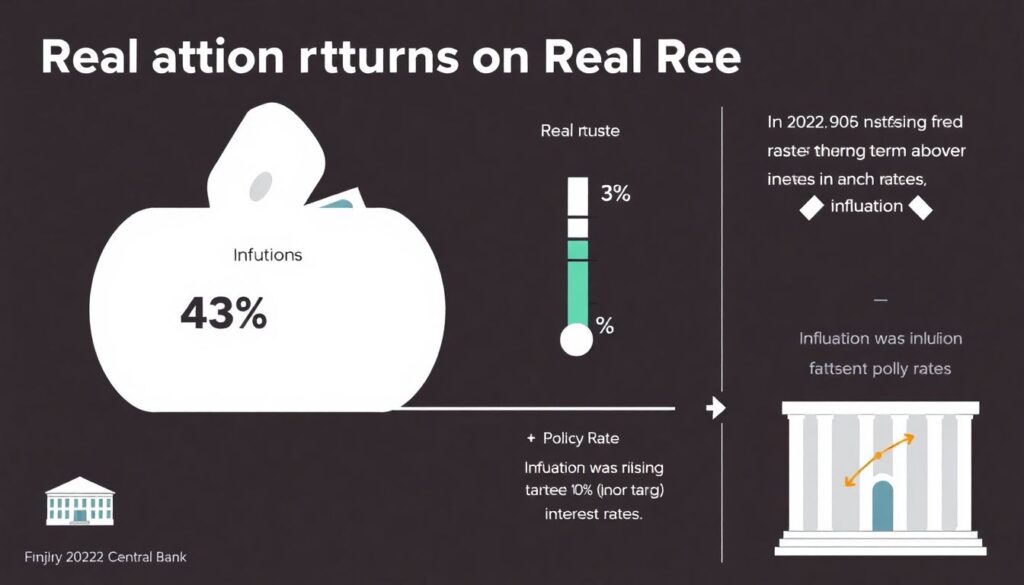

Technical detail: real vs nominal returns on cash

Even with higher nominal yields, your real return depends on inflation. If your savings account pays 4% but inflation runs at 3%, your real gain is roughly 1%. Central banks target inflation—often around 2%—and use policy rates to steer expectations toward that level. In 2022 inflation outpaced short‑term rates, giving savers negative real returns despite hikes. By late 2023 and into 2025, disinflation plus high policy rates improved real yields on deposits and Treasury bills. For long‑term planning, comparing your cash yield with both current inflation and expected inflation helps you decide how much to keep liquid versus investing in longer‑duration assets.

How 2025 trends differ from the last decade

The 2010s were defined by “lower for longer” rates and repeated central bank stimulus. In contrast, the 2022–2025 cycle is about normalisation and then fine‑tuning. Structural forces—aging populations, higher public debt, supply‑chain rewiring, and decarbonisation—are all putting mixed pressure on inflation and growth. Markets now expect more volatile rate paths: sharper hiking phases when inflation surprises, followed by cautious cuts rather than a quick return to zero. For households, this means planning under uncertainty: variable‑rate debt is riskier than it looked before the pandemic, and the opportunity cost of holding too much idle cash has decreased but not disappeared.

Practical checklist for adapting your finances

To keep your wallet resilient in a world of shifting central bank policy, treat interest exposure like any other financial risk. Map out where higher rates hurt you and where they help. Typically:

– Liabilities: mortgages, credit cards, student and auto loans, margin accounts.

– Assets: savings accounts, CDs, money market funds, bonds and bond ETFs.

Once you see the full picture, you can hedge naturally: for example, offset a large fixed‑rate mortgage with more floating‑rate savings products, or vice versa. Review your structure at least annually or after major policy shifts, using central bank press conferences not as background noise but as triggers to reassess your personal balance sheet.

Bringing it all together: turning policy noise into action

Central bank decisions in 2025 will keep dominating financial headlines, but they don’t have to feel abstract. Each rate move translates into concrete changes in your monthly cash flow: mortgage payments, card interest, savings yields and refinancing options. Instead of trying to predict every step, focus on building a structure that can withstand both hikes and cuts: less high‑APR debt, smarter use of fixed versus variable rates, and more active management of where your cash sits. Treated this way, policy announcements become a useful early‑warning system—and an occasional opportunity—rather than just another stream of confusing jargon.