Why fixed and variable expenses matter when you’re just starting

When you’re dealing with personal budgeting for beginners, the biggest unlock is understanding the difference between fixed and variable expenses. Fixed costs are the predictable ones: rent, mortgage, car payment, basic insurance, subscriptions on autopay. Variable expenses flex from month to month: groceries, dining out, transport, fun, impulse buys. First‑time budgeters often underestimate variables and then wonder why their plan “never works.” Seeing that your fixed expenses already eat, say, 60–70% of income quickly shows how much real room you have for savings goals and lifestyle choices, and whether you need to renegotiate bills or cut back on non‑essentials.

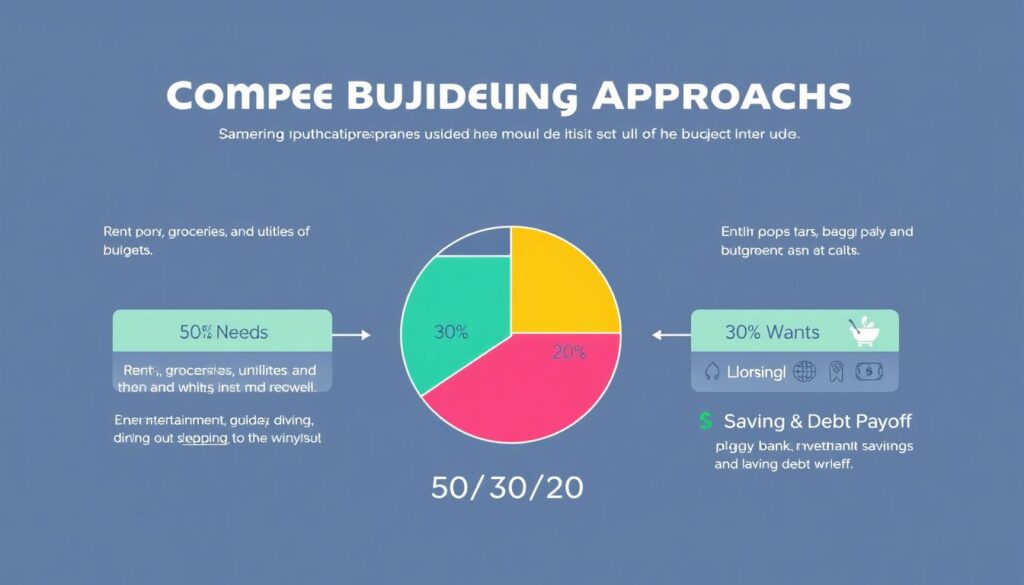

Comparing main approaches to budgeting for first‑timers

When you compare different approaches, you’re really deciding how tightly you want to control each dollar. Below is a quick rundown of common models and how they treat fixed and variable costs:

1. Percentage rules (like 50/30/20) keep it simple: 50% needs, 30% wants, 20% saving and debt payoff. Good for a fast start, but it can hide overspending in “wants.”

2. Zero‑based budgeting assigns every dollar a job. It’s precise and exposes bloated variable categories, yet can feel time‑consuming.

3. Digital “envelopes” simulate cash envelopes in apps; very intuitive, but some people find category limits too rigid.

4. “Pay‑yourself‑first” emphasizes automated saving; efficient, though it assumes your fixed expenses are already under control.

Tech tools: apps, planners and calculators

Instead of spreadsheets only, most beginners now mix a budget planner for tracking fixed and variable costs with digital tools. The best budgeting apps for managing fixed and variable expenses automatically sync transactions, categorize spending and highlight recurring payments you forgot you had. Their strengths are visibility, alerts and simple dashboards; weaknesses are subscription fees, data‑privacy concerns and occasional mis‑categorization. An online budget calculator for first-time budgeters helps you test scenarios in minutes: “What if I move to a cheaper apartment?” or “What if I pay off this loan early?” A basic paper or PDF planner is still useful as a low‑friction space for monthly reviews and quick recalculations.

How to create a monthly budget step by step

If you want how to create a monthly budget step by step, think in layers. First, list income after tax, including side gigs and irregular bonuses. Second, map every fixed cost: housing, utilities, minimum debt payments, mandatory insurance, subscriptions. Third, estimate variable categories based on the last 2–3 months of statements; don’t guess, use real data. Fourth, define targets for savings, investing, and extra debt payoff. Fifth, pick your framework: maybe a simple 50/30/20 rule or a semi–zero‑based approach for just a few “problem” categories. Finally, schedule a 20‑minute review every week to compare the plan with actuals and adjust categories instead of abandoning the whole system.

Choosing your method and avoiding common traps

There’s no universal “best” system; the right one matches your temperament and tech comfort level. If you hate micromanagement, start with broad percentage buckets plus one or two “watch” categories like dining out or delivery. If you’re prone to impulse spending, a stricter envelope or zero‑based structure might keep you honest. Look for a budget planner for tracking fixed and variable costs that you’ll actually open, not the most feature‑rich tool on paper. Typical traps: forgetting annual or quarterly bills, ignoring subscription creep, and assuming last month’s low expenses were “normal” when they were actually an exception.

Trends in first-time budgeting tools and habits for 2025

In 2025, first-time budgeting leans heavily on automation and behavioral nudges. Many of the best budgeting apps for managing fixed and variable expenses now integrate real‑time cash‑flow forecasts and AI‑based alerts that flag when today’s spending will cause a shortfall before next payday. Banks embed “micro‑budgets” directly into their apps, offering a built‑in online budget calculator for first-time budgeters instead of separate software. There’s a clear trend toward “invisible budgeting,” where recurring transfers, dynamic spending limits and push notifications quietly enforce your plan. At the same time, creators popularize analog check‑ins—weekly notebook reviews—to keep decisions intentional instead of letting automation run on autopilot.