What Is Cash Flow and Why It Matters

Understanding the Basics

Cash flow refers to the movement of money into and out of your business or personal finances over a specific period. Think of it like the way water flows through a pipe: if more water comes in than goes out, the pipe fills up. If more goes out than comes in, eventually the pipe runs dry. Similarly, positive cash flow means you have more money coming in than you’re spending, while negative cash flow signals more expenses than income.

There are three main types of cash flow:

– Operating cash flow: Money generated from core business activities like sales or services.

– Investing cash flow: Cash from buying or selling assets such as equipment or real estate.

– Financing cash flow: Money that comes from external sources like loans or investor funding.

Why Cash Flow Differs from Profit

Many beginners confuse cash flow with profit. Here’s the key difference: *Profit* is what remains after all expenses are subtracted from revenue, often shown on an income statement. *Cash flow*, on the other hand, tracks actual cash moving in and out, regardless of when it’s earned or incurred. For example, you might show a profit on paper but still be unable to pay your bills if your customers haven’t paid their invoices yet.

Let’s take a small bakery as an example. In December, it might sell $10,000 worth of cakes (revenue), with $6,000 in expenses, showing a $4,000 profit. But if only half of the customers pay in December and the rest in January, the actual cash flow for December is only $5,000 — not enough to cover rent and wages. That’s a real-world cash crunch.

Visualizing Cash Flow: A Simple Diagram

Imagine a funnel. At the top, you pour in:

– Customer payments

– Investment returns

– Loan proceeds

At the bottom, cash flows out through:

– Rent

– Salaries

– Supplier payments

The difference between what goes in and what comes out is your net cash flow. Tracking this monthly helps you determine how healthy your finances are.

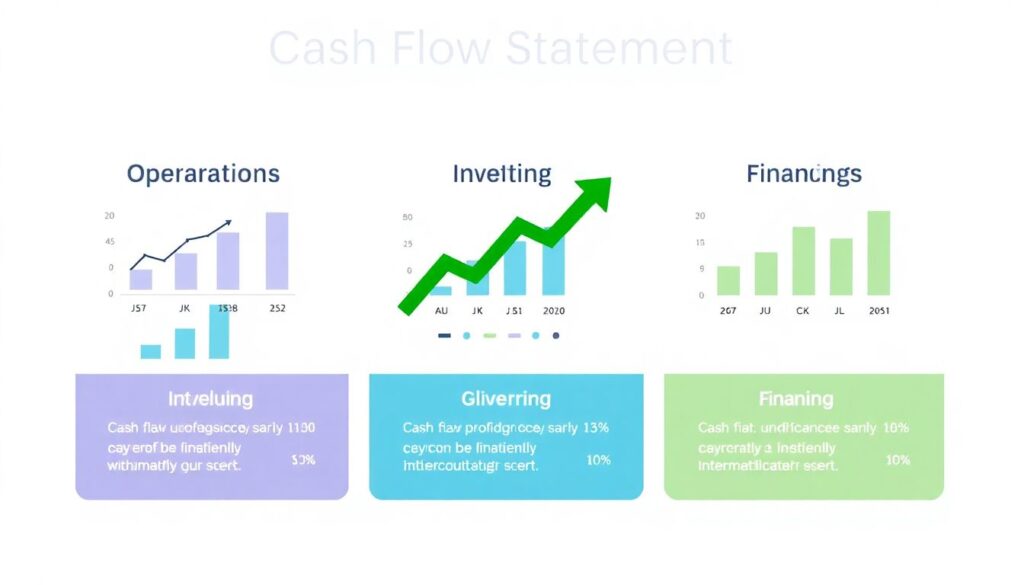

How to Read a Cash Flow Statement

A cash flow statement is a financial report that summarizes the cash inflows and outflows over a certain time period. It’s usually divided into the three categories we mentioned earlier: operations, investing, and financing. Here’s what to pay attention to:

– A consistently positive operating cash flow indicates a sustainable business model.

– Negative investing cash flow often means you’re growing or upgrading.

– Positive financing cash flow usually signals new debt or investor capital, while negative means you’re repaying loans or distributing dividends.

Case Study: Freelance Designer’s Cash Flow Struggles

Maria, a freelance graphic designer, earns around $5,000 per month in client contracts. But her cash flow was chaotic. Why? Most clients paid her 30 to 45 days after invoicing. Meanwhile, rent, software subscriptions, and taxes were due monthly.

Her solution:

– She started requesting 50% upfront payments

– Used accounting software to track overdue invoices

– Created a cash buffer equal to two months of expenses

Within three months, she stabilized her cash flow and no longer relied on credit cards to bridge gaps. This is a classic example of how understanding and managing cash flow can relieve financial stress, even when income is steady.

Tools and Tips to Manage Cash Flow

Practical Steps for Beginners

If you’re just starting out, managing cash flow can feel overwhelming. But there are simple steps to get started:

– Track everything: Use apps like QuickBooks, Wave, or Excel to record every dollar in and out.

– Forecast regularly: Predict your cash flow for the next 3–6 months so you can anticipate shortfalls.

– Delay expenses when possible: Negotiate payment terms with vendors or delay non-essential purchases.

Common Cash Flow Pitfalls

Avoiding these mistakes can save you from unnecessary headaches:

– Overestimating incoming cash (especially from unpaid invoices)

– Ignoring seasonal fluctuations (like slow months for retailers in January)

– Failing to set aside tax payments

Comparing Cash Flow with Other Financial Metrics

Cash flow is one of several key financial indicators. Others include:

– Net income: Shows profitability but doesn’t reflect actual cash.

– Working capital: Measures liquidity but only at a snapshot in time.

– Burn rate (for startups): How quickly you’re spending money compared to income.

While these metrics are useful, cash flow is arguably the most immediate and practical measure of financial health. You can be profitable but still go bankrupt if you run out of cash — a scenario that’s more common than you’d think.

Conclusion: Building Cash Flow Confidence

Understanding cash flow isn’t just for accountants or CFOs—it’s a vital skill for freelancers, small business owners, and even households. By learning how money moves through your system, you can make smarter decisions, avoid surprises, and build a more resilient financial future.

Start small. Track your cash weekly. Look for patterns. And remember: profits are important, but cash is king.