Why Budgeting Feels Hard (And Why It’s Not a Math Problem)

Most people don’t struggle with numbers; they struggle with uncertainty and habits. When you first start earning, money behaves like sand in your hands: you’re sure you had it, but it’s gone by the end of the month. A practical budget is less about rigid spreadsheets and more about building a clear feedback loop: “I earn this, I spend that, I choose this.” Once you see where your cash actually goes, decisions become less emotional and more like adjusting knobs on a dashboard.

Step Zero: Define What “Winning With Money” Means for You

Before you open any app, decide what “good” looks like. For one person it’s paying off $2,000 of credit card debt in a year. For another it’s building a $1,500 emergency fund in six months. If you skip this step, any budgeting system will feel pointless after a few weeks, because there’s no scoreboard. Take 10 minutes, write down three money goals, and attach numbers and deadlines to each. A vague “I want to save more” turns into “I want $100 per month automatically moved to savings for 12 months.”

—

TECHNICAL BLOCK: Turning Wishes Into Measurable Goals

– Replace “more / less” with actual numbers.

– Use the formula: Goal = Amount + Purpose + Deadline.

– Example: “Save $600 for a new laptop in 6 months” → $100 per month.

– If the monthly number feels impossible, keep the goal but stretch the deadline, not the other way around.

—

How to Start a Budget From Scratch Without Overcomplicating It

If you want to know how to start a budget from scratch, do it with as little structure as you can get away with for the first month. You’re not sculpting the perfect system right away; you’re just collecting data. For 30 days, track every expense with the least annoying method you can stand: phone notes, bank app exports, or a minimalist tracker. Your only task in month one is to answer: “Where did my last paycheck really go?” Even if your categories are messy, you’ll see patterns you cannot unsee—like $180 on food delivery or $90 in forgotten subscriptions.

—

TECHNICAL BLOCK: Minimalist First-Month Tracking Setup

1. Open a blank note on your phone.

2. Each time you pay, jot “Date – Store – Amount – Category (rough).”

3. End of week: add up by category (food, rent, transport, fun, debt, other).

4. End of month: calculate % of income per category (category ÷ income × 100).

5. Circle the top two categories where you’re surprised or annoyed. Those are your first levers.

—

A Simple Framework: The 60 / 30 / 10 Reality Check

A lot of “rules of thumb” exist (50/30/20, etc.), but they often ignore your actual cost of living. Instead, use a reality-first approach. After tracking for a month, sort your spending into three buckets:

– Musts – rent, basic groceries, utilities, minimum loan payments, transport to work.

– Wants – restaurants, streaming, hobbies, impulse buys.

– Future You – savings, investments, extra debt payments.

For many young adults in cities, the first snapshot looks like 70–80% Musts, 15–25% Wants, 0–5% Future You. The goal is not to hit some magical percentage on day one, but to gradually move towards something like 60% Musts, 30% Wants, 10% Future You, then maybe 55/25/20 as income grows. The budget becomes a negotiation between Present You and Future You instead of a guilt list.

—

TECHNICAL BLOCK: Quick Percentage Check

– Total monthly income after tax: e.g., $2,000.

– Musts: $1,500 → 75%

– Wants: $350 → 17.5%

– Future You: $150 → 7.5%

If Future You is under 5%, look for one or two recurring costs you can shrink by at least $25 each. You’re not aiming for perfection, just a visible dial moving in the right direction.

—

Non-Standard Move: Budget Backwards From Joy, Not From Bills

Most advice starts from rent and bills. Try flipping it for once. List three things that actually make your life feel richer—maybe rock climbing twice a month, good coffee, or weekend train trips. Put a rough monthly price tag on each: say $60, $40, and $80. That’s $180. Lock that $180 into your plan as “Protected Joy Money.” Then squeeze all the boring, negotiable stuff first: overpriced phone plans, delivery, random online shopping. This way you’re not “cutting fun,” you’re cutting whatever doesn’t rank high enough to be protected.

This backwards approach matters psychologically. If your brain thinks “Budget = Less Life,” it will quietly sabotage your efforts. When “Budget = Making Room For The Stuff I Genuinely Love,” it becomes easier to say no to the fifth streaming service or the late-night impulse order.

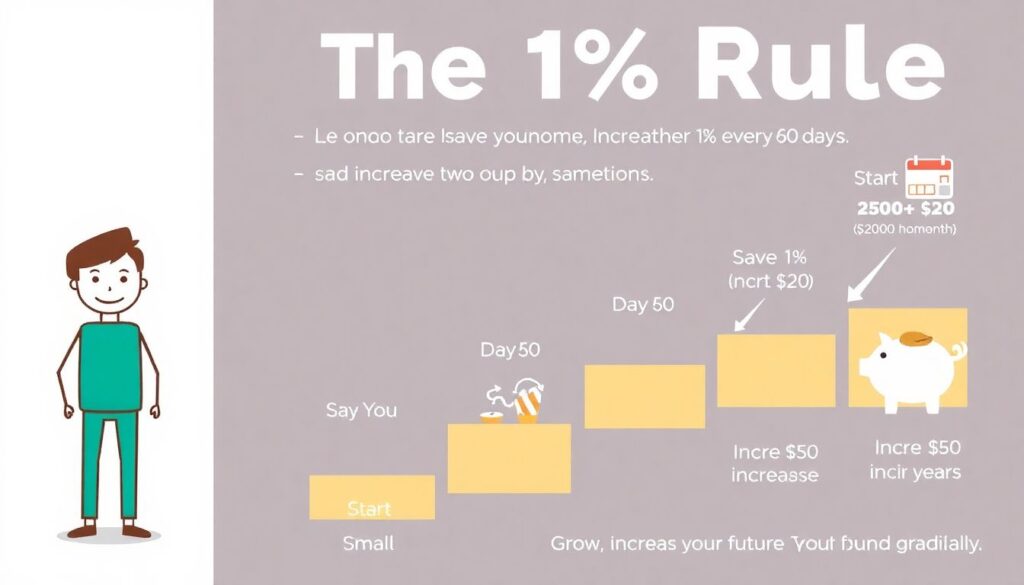

The 1% Rule: Micro-Saving So It Doesn’t Hurt

One unconventional tactic is the 1% Rule. Instead of trying to go from 0 to 20% savings overnight, increase your “Future You” contribution by just 1% of take-home income every two months. If you earn $2,000, start with $20. In 60 days, bump it to $40. In another 60 days, go to $60. Over a year, you’ll have stepped up to around 6% without a sense of deprivation, and you’ll have tested where discomfort actually starts. This incremental approach works especially well for people whose income is still growing and unstable.

—

TECHNICAL BLOCK: 1% Rule Over One Year (Example)

– Month 1–2: $20 → $40 saved

– Month 3–4: $40 → +$80 (total $120)

– Month 5–6: $60 → +$120 (total $240)

– Month 7–8: $80 → +$160 (total $400)

– Month 9–10: $100 → +$200 (total $600)

– Month 11–12: $120 → +$240 (total $840)

These are small enough jumps to be realistic even with rising costs, yet they build a visible savings habit.

—

Real-Life Example: Two Friends, Same Income, Different Results

Imagine two 24‑year‑olds, both taking home $2,200 per month.

– Alex doesn’t track anything, just pays bills and “tries to spend less.” Rent is $900, food and delivery $550, fun $400, everything else $350. By the end of the month, Alex keeps wondering, “Where did it go?” Savings: basically zero most months, despite good intentions.

– Taylor decides to act as a one-person budgeting for beginners course. First month: no restrictions, just tracking. Shock moment: $230 in delivery, $75 in unused subscriptions. Taylor cancels $50 of those subscriptions, limits delivery to twice a month ($80), and redirects $150 into an automatic savings transfer scheduled the day after payday. In 12 months, that’s $1,800 saved, with a lifestyle that still includes eating out and fun, just more deliberately.

The key difference isn’t discipline; it’s visibility plus one or two concrete decisions that persist for months.

Using Tech Smartly: Apps, Not Spreadsheets, Do the Heavy Lifting

If you hate spreadsheets, skip them. Modern tools can categorize and visualize spending for you in a few taps. The best budgeting apps for beginners have three things in common: automatic syncing with your bank, easy category editing, and clear alerts when you’re overspending in a category. Look for apps that let you create rules like “anything from this store = groceries” to reduce manual input. What matters is not the brand of the app but whether you open it at least twice a week for 60 seconds to check your dashboard. That short check‑in is where new habits form.

If apps feel overwhelming, go analog-but-light: use a simple monthly budget planner printable, stick it on your wall, and just update the totals once a week from your bank app. For many beginners, physically seeing the numbers on paper near their desk or fridge makes spending feel more real than scrolling through endless transactions on a screen.

Extreme Simplicity: The Three-Account System

Here’s an unconventional but very practical setup that often beats complex category systems:

1. Bills Account – salary arrives here, covers rent, utilities, minimum loan payments, subscriptions you actually use.

2. Spending Account – you transfer a fixed weekly amount to this one; it’s for food, going out, small shopping. When it’s empty, you’re done until next week.

3. Future You Account – automatic transfer the day after payday; no card attached, ideally at a different bank so you have to think twice before touching it.

By dividing money physically like this, you make overspending harder without constant willpower. This is a way to “automate discipline” so you don’t rely on motivation every weekend.

—

TECHNICAL BLOCK: Sample Three-Account Distribution on $2,000 Income

– Bills Account: $1,200 (rent $800, utilities $100, transport pass $80, phone $40, minimum debt $180)

– Spending Account: $500 (→ $125 per week)

– Future You Account: $300 (emergency fund or extra debt payment)

Even if numbers shift month to month, the structure stays stable, which simplifies decisions.

—

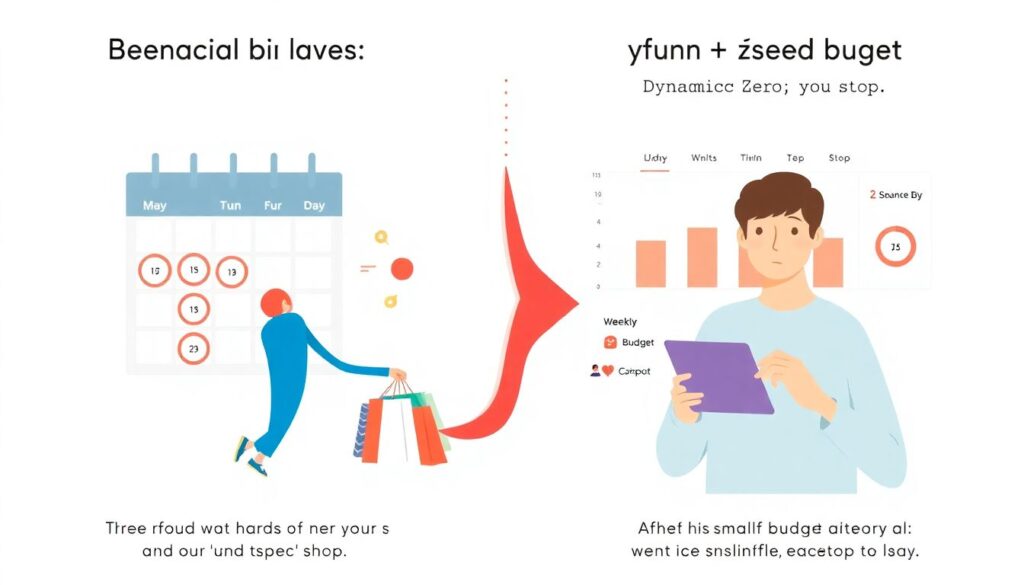

Non-Standard Trick: “Dynamic Zero” Instead of Strict No-Spend Days

Classic advice: do “no spend days.” For many people, that backfires—one strict day leads to a rebound binge tomorrow. Instead, use a dynamic zero rule: at any given moment, you have a planned amount left in your weekly “fun + food” budget. When you hit zero, you stop, but you’re allowed to shuffle spending during the week.

Example: you start the week with $130. You spend $40 on a night out, $20 on groceries, $10 on coffee. You’ve got $60 left. You can choose: another dinner out, or a movie + extra groceries. You are constantly re‑trading options instead of seeing “no spend” as punishment. This keeps the psychological pressure lower and makes the budget feel like a strategy game rather than a diet.

When to Ask for Help: Coaching and Accountability

If you’re new to earning your own money and feel stuck, external accountability can be a shortcut. Some people benefit from personal finance coaching for young adults, where a coach helps them set priorities, choose tools, and review progress monthly. Others create low‑key “money clubs” with friends—30 minutes once a month where everyone opens their bank app, updates their numbers, and shares one win and one challenge. You don’t need a professional to get started, but you do need at least one other human who knows about your goals and will ask how they’re going.

If you want something more structured but cheaper than one‑on‑one help, look for a live or online budgeting for beginners course that includes homework and Q&A, not just pre‑recorded videos. The content itself may be similar across courses; the real value is in the practice and the chance to ask “weird” questions specific to your situation.

How to Keep Going When Motivation Fades

Motivation always dips after the first burst of enthusiasm. Plan for that in advance:

1. Automate the important moves. Savings transfer, bill payments, and debt overpayments should run even if you forget.

2. Shrink the check‑in ritual. Two minutes on Sunday: open your app, check total spent vs. plan, decide one micro-adjustment for next week.

3. Celebrate boring wins. “Kept groceries under $200 this month” is a bigger milestone for your future than a one-time bonus.

—

TECHNICAL BLOCK: Monthly Review Checklist (10 Minutes)

1. Total income vs. last month.

2. Total spent, and the two categories that grew the most.

3. Amount moved to Future You (savings + extra debt).

4. One thing to reduce by $20 next month.

5. One thing you’re allowed to upgrade slightly because you did well (e.g., better coffee, a book, a class).

Attaching a small, guilt‑free upgrade to each positive month keeps your brain associating budgeting with progress, not deprivation.

—

Final Thoughts: Your First Budget Is a Prototype, Not a Lifetime Contract

Your first budget is just Version 0.1 of your money system. You’ll change jobs, move homes, start or stop subscriptions, maybe take on or pay off debt. That’s normal. What matters is not building the “perfect” plan today, but learning a repeatable process you can re‑run whenever life changes.

Think of your budget as a living document that answers three questions:

1. What do I really care about enough to protect in my spending?

2. How much am I sending to Future Me every month, on purpose?

3. What is one small lever I can adjust this month without feeling miserable?

If you keep answering those questions and adjusting your system—whether using an app, a notebook, a simple monthly budget planner printable, or the three‑account method—you’re already far ahead of most people your age. The numbers will follow the habits, not the other way around.