Category: Smart Saving

-

Smart budgeting for beginners: practical steps to take control of your money now

Why “Smart Budgeting” Sounds Boring — And Why You’ll Love It Anyway Money talk usually makes people tense. Spreadsheets, categories, restrictions — not the most exciting way to spend an evening. But smart budgeting for beginners is less about punishment and more about permission: permission to say “yes” to things that действительно важны, без ощущения…

-

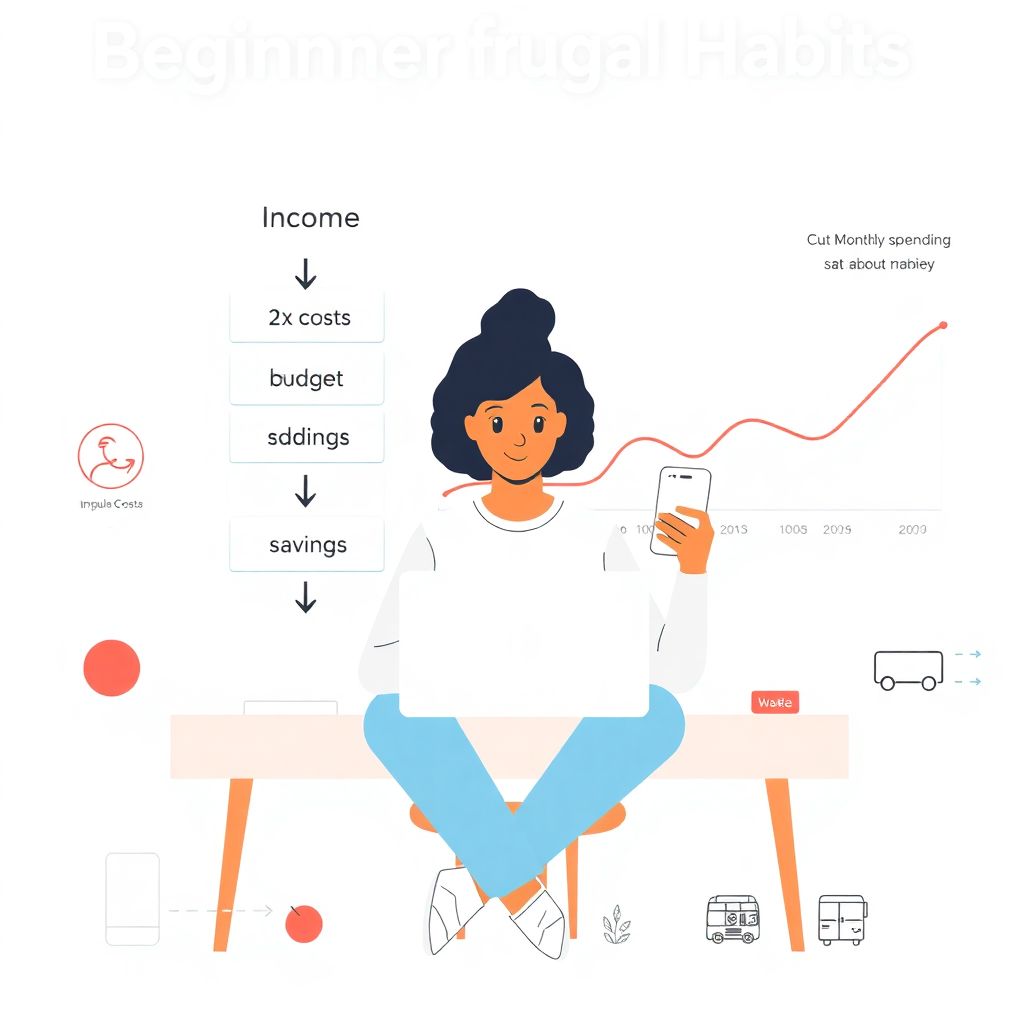

Frugal habits for beginners: simple ways to start spending less every day

Most people don’t wake up thinking, “I want to be frugal.” They think, “I’m tired of feeling broke.” Frugal habits for beginners are about exactly that: spending less without feeling like your life has been downgraded to “no fun allowed.” Below is a technical—but still human—breakdown of how to do it, backed by recent numbers…

-

Budgeting and saving for beginners: a first-timer’s guide to managing your money

Why Budgeting Isn’t Just for “Money People” Think of a budget not as a punishment, but as a navigation system. Technически, бюджет — это план распределения денежного потока по временным интервалам, где каждый доллар получает конкретную функцию: «тратить», «накопить», «погасить долг». В отличие от абстрактного “я стараюсь меньше тратить”, бюджет фиксирует предельные значения по категориям….

-

Intro to budgeting literacy: key money concepts for beginners

Why Budgeting Literacy Matters (Even If You “Hate Numbers”) Budgeting isn’t about becoming an accountant or tracking every cent in a spreadsheet. It’s about answering three basic questions: – What’s coming in? – Where is it going? – Is that getting me closer to the life I want? Budgeting literacy is simply the skill of…

-

Simple budgeting for tech-savvy beginners: a practical guide to your first budget

Why tech-savvy beginners still struggle with money If you’re comfortable switching between apps, managing cloud storage and tweaking smartphone settings, но всё равно не понимаете, куда исчезают деньги каждый месяц, ты точно не один. Технологичность не гарантирует финансовую грамотность: наоборот, быстрые платежи, подписки в один клик и бесконечные распродажи делают расходы почти невидимыми. В этой…

-

Budgeting for a new job: achieve financial clarity during your career transition

Why budgeting for a new job feels weirdly hard Starting a new job should feel like pure progress: bigger paycheck (hopefully), new team, fresh routines. Yet именно в этот момент деньги часто начинают ускользать. Доход меняется, расходы «под это подстраиваются», и через пару месяцев человек удивлённо смотрит на счёт: «Куда всё делось?» Вопрос *how to…

-

Understanding your budget as a beginner: simple steps to manage your finances wisely

Why Budgeting Matters More Than You Think Most beginners assume budgeting is just about tracking expenses. In reality, it’s a foundational tool for financial freedom. Whether you’re trying to pay off student loans, save for a house, or just avoid overdraft fees, a personal budget helps you take control instead of reacting to every unexpected…

-

Sustainable budget plan for effective money management and long-term financial stability

Understanding the Concept of a Sustainable Budget Plan A sustainable budget plan is more than just a monthly spreadsheet of income and expenses. It is a long-term financial strategy designed to ensure that spending habits, savings goals, and debt management are aligned with one’s financial capacity and life objectives. The key word is “sustainable” —…

-

Budgeting for a side hustle: how to manage and grow your extra income wisely

Budgeting for a Side Hustle: Handling Extra Income In today’s gig economy, more people than ever are earning extra income through side hustles — from freelance design and food delivery to tutoring and e-commerce. While this additional stream of cash can feel like “bonus money,” without a clear budgeting strategy, it can drift into financial…

-

Budgeting tips for first-time home buyers to create a practical and effective financial plan

Comparing Budgeting Approaches for First-Time Home Buyers First-time home buyers in 2025 are faced with a broader range of budgeting strategies than ever before. Traditional methods, such as the 28/36 rule (spending no more than 28% of income on housing and 36% on total debt), remain widely recommended. However, newer strategies emphasize dynamic budgeting based…