Why Minimalist Budgeting Feels Different

Minimalist budgeting starts from a different question than classic personal finance. Instead of “How do I afford everything I want?”, you ask “What do I actually want to keep in my life long term?”. This shift turns your budget into a filter, not a cage: every expense must justify the space it takes in your time, attention and cash flow. In practice, a minimalist lifestyle budget planner is less about colorful charts and more about mapping fixed obligations, essential needs and a short list of “high‑value” luxuries. You treat money as a finite bandwidth resource, similar to CPU or storage, and design your spending so that recurring payments don’t overload your system or crowd out activities that create genuine satisfaction and mental clarity.

Minimalism also changes how you measure success. Traditional advice focuses on net worth, savings rate and return on investment; these metrics still matter, but they’re not the only performance indicators. You also track qualitative signals: reduced decision fatigue, lower financial anxiety, more time for deep work or relationships, fewer impulse purchases. The budget becomes a feedback loop between your values and your behavior: you run a “before” snapshot of your current expenses, define a target minimalist lifestyle, then iterate monthly, deprecating non‑critical cost items and reallocating the released funds toward goals such as debt reduction, an emergency buffer or extended time off. Over time, the system rewards consistency and honest data more than heroic frugality sprints.

Core Tools and Systems You Actually Need

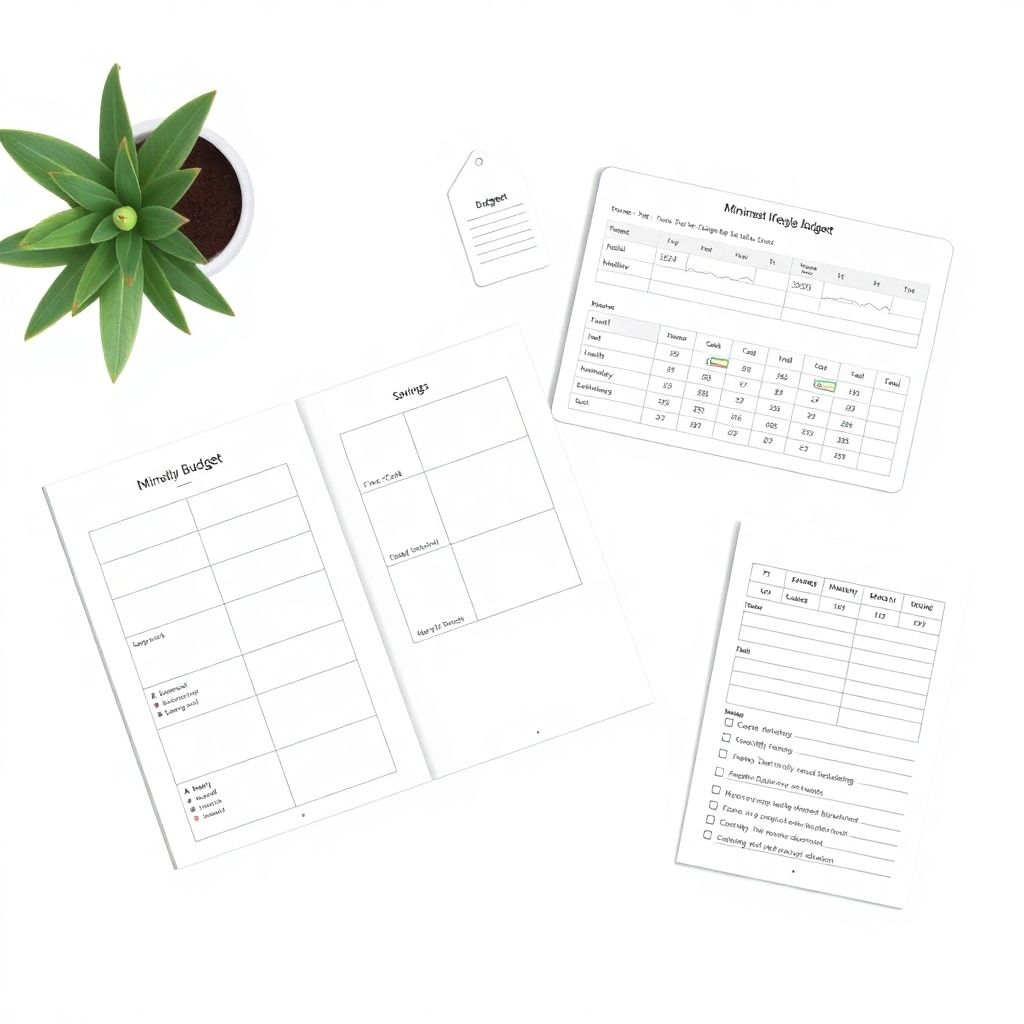

You can run a minimalist budget on paper, but a lightweight tool stack reduces friction and error rates. At the center is a simple tracking mechanism: a notebook, spreadsheet or dedicated app that logs cash flows by category with timestamps. Think of it as your personal ledger database, not a decorative journal. If you enjoy analog planning, a printed minimalist lifestyle budget planner with pre‑defined sections for fixed costs, variable essentials and “optionals” might align better with a low‑tech routine. If you prefer automation, the best budgeting apps for minimalist lifestyle users are those that import transactions automatically, allow custom tags like “clutter” versus “core”, and support zero‑based allocation without pushing credit offers or complex investment products.

Besides a tracker, you need a value hierarchy and a few numeric guardrails. The value hierarchy is a written one‑page document ranking spending domains such as housing, mobility, learning, health, relationships and rest. This acts as your requirements spec when choosing which expenses to eliminate or downgrade. Guardrails are simple quantitative constraints: a maximum housing‑to‑income ratio, a minimum savings rate, a cap on discretionary categories like dining out or digital subscriptions. Rather than chasing dozens of micro‑rules, you maintain three to five metrics you can review weekly in under ten minutes. The combination of these tools forms a lightweight control system that surfaces anomalies quickly, such as subscription creep or lifestyle inflation, before they become structural budget defects.

Step‑by‑Step: How to Budget for Minimalist Living

If you are wondering how to budget for minimalist living without overwhelming yourself, think in phases, not one giant overhaul. Phase one is diagnostics: export the last two to three months of bank and card statements and classify each item as “essential”, “meaningful optional” or “non‑essential”. Don’t optimize yet; just label. This creates your baseline spend profile and exposes high‑frequency leaks like small daily purchases that add little value. Phase two is redesign: decide on a target monthly spend per category based on your income, risk tolerance and priorities. Here, you implement zero‑based logic: every dollar is assigned a job, whether that’s rent, food, savings, debt service or intentional leisure, leaving no unallocated residue that can quietly evaporate on autopilot.

Phase three is deployment: you convert your target budget into concrete rules linked to your payment systems. For example, you route fixed bills and savings transfers to separate accounts scheduled right after payday, effectively treating them as non‑negotiable system processes. Variable expenses such as groceries or entertainment are funneled through specific cards or e‑wallets with weekly spending caps. You then schedule a recurring 20‑minute “budget stand‑up” once a week to compare planned versus actual totals, adjust for reality and record lessons learned. Over two to three months, this iterative loop stabilizes; your budget stops feeling like a crash diet and starts operating like a low‑maintenance protocol that gracefully handles small deviations without you needing to micromanage every line item.

Comparing Popular Minimalist Budgeting Approaches

Minimalist budgeting isn’t one monolithic method; several frameworks compete, each with trade‑offs. The classic percentage‑based model, such as 50/30/20, is simple: you allocate fixed shares of income to needs, wants and savings. Its advantage is cognitive ease and quick setup, which suits beginners or people with steady salaries. However, it can be too coarse for a serious minimalist lifestyle, because it doesn’t force you to question whether a “want” is truly aligned with your values or just a socially normalized habit. In contrast, zero‑based budgeting assigns every unit of currency to a specific job, making invisible waste visible. This approach offers higher precision and intentionality, but it involves more configuration overhead, particularly during the first few months while you calibrate realistic category ceilings.

Another dimension is how strictly you separate money into containers. Envelope budgeting, whether physical cash envelopes or digital sub‑accounts, works like RAM allocation: once a category’s envelope is empty, spending stops. Many minimalists like the behavioral clarity: you literally see scarcity and can’t silently overspend. The downside is friction; cash handling or juggling multiple accounts can feel clunky in a largely cashless ecosystem. A more flexible approach is values‑based budgeting, where you aggressively defund low‑priority areas and overfund a few meaningful ones, even if that breaks standard percentage rules. For example, a person might downsize housing and car expenses to free a larger share of income for travel or creative projects. A structured minimalist budgeting course for beginners often walks through these models, helping you prototype each for a month and then adopt a hybrid that matches your temperament, attention span and risk profile.

Troubleshooting: When Your Minimalist Plan Breaks

Even a well‑designed budget will drift; treating errors as bugs, not failures, keeps you adaptive. The most common issue is underestimating real‑world costs, leading to chronic overspend in one or two categories. When this happens, the fix isn’t more willpower but recalibration: increase the limit for that category to a sustainable level, then deliberately reduce low‑value spending elsewhere so the total equation still balances. Another frequent defect is “all‑or‑nothing” behavior, where one bad week triggers total abandonment of the plan. To counter this, define explicit thresholds: for instance, if you overshoot a category by up to 10%, you simply adjust next week’s micro‑targets; only persistent overruns trigger structural changes like renegotiating housing or canceling services. By encoding these rules, you avoid emotional overreaction and treat anomalies as data points in an ongoing experiment.

Sometimes the issue isn’t numerical at all but psychological: boredom, social pressure or decision fatigue. Here, a minimalist lifestyle financial planning guide can help you reconnect the numbers with your bigger narrative—why you chose minimalism, what trade‑offs you’re willing to accept and which ones are non‑negotiable. You might discover that you cut too aggressively in areas that support mental health or relationships, creating backlash and rebound spending. Periodic “retrospectives” every quarter allow you to re‑prioritize, upgrade certain categories and intentionally add a few “joy expenses” that deliver high satisfaction per dollar. If you keep the toolset lean, your rules transparent and your experiments small, your budget evolves from a rigid cost‑cutting script into a stable, minimalist operating system that quietly supports the life you actually want instead of the one advertisers design for you.