Why “Realistic” Budgeting Matters More Than Perfect Spreadsheets

Most people don’t struggle because they can’t do math; they struggle because traditional advice ignores real life. Rents jump, friends call you out for dinner, your kid suddenly needs new sneakers. A realistic approach to budgeting for beginners accepts that life is messy and builds a flexible plan around that, instead of pretending every month will look like a textbook example. Behavioral economists point out that small, sustainable changes beat radical financial “diets”, so your first goal is not a flawless plan, but a system you can stick with even on bad weeks. Think of a budget as a navigation app: it keeps recalculating the route, but only if you keep feeding it honest data about where you actually are.

Essential Tools: From Apps to Pen and Paper

To keep things simple and evidence‑based, start with just a few tools that help you capture income and spending without friction. Many experts recommend choosing either one of the best budgeting apps for beginners or a very basic notebook, but not both at once, so you don’t split your attention. Apps can automatically categorize card transactions, send alerts, and generate charts, which is handy if you like visuals and already use your phone for everything. On the other hand, a handwritten personal budget planner for beginners often makes spending feel more “real” because you physically write each number, improving awareness and memory. The best tool is the one you will actually open three times a week, not the fanciest one on a finance blog.

Setting Up Your Foundation: Money In, Money Out

Before searching “budgeting for beginners step by step” and drowning in templates, begin with a very honest snapshot of your current situation. List every source of income that reliably arrives in your account: salary after tax, side gigs, stipends, benefits. Then map your fixed costs: rent or mortgage, utilities, minimum debt payments, essential insurance, transportation passes. Experts in financial counseling suggest going through the last two to three months of bank statements and card histories to identify hidden patterns, such as small but frequent food delivery orders or subscription services you forgot. This baseline is not about judgment; it’s a diagnostic, like a blood test, that shows where your money actually flows before you try to redirect it.

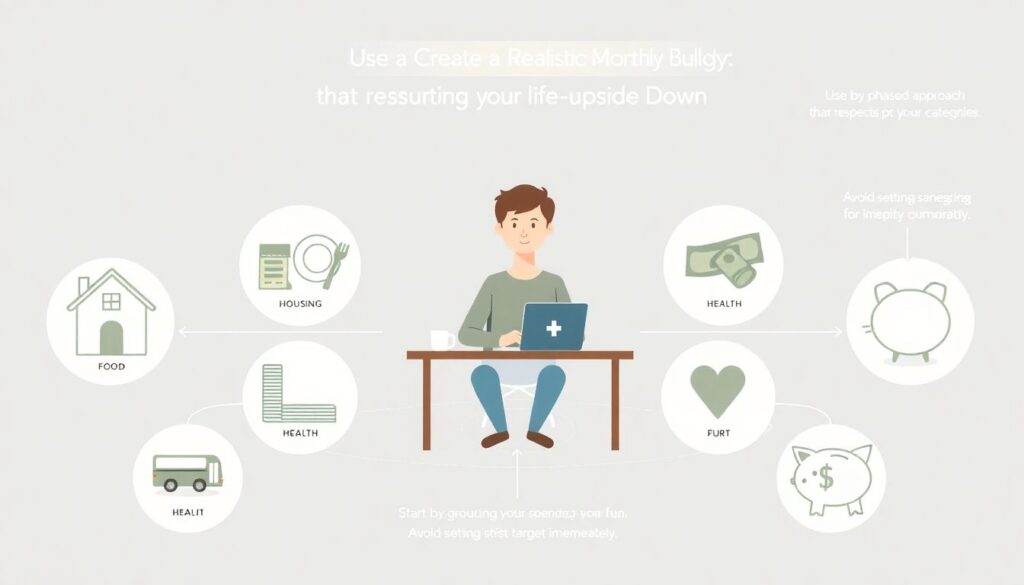

How to Create a Realistic Monthly Budget: A Step‑by‑Step Path

If you want to know how to create a realistic monthly budget without turning your life upside down, use a phased approach that respects your habits. Start by grouping your spending into broad categories: housing, food, transport, debt, health, fun, savings. Avoid setting strict targets immediately; instead, record what you usually spend in each area to detect where there is room to tighten without feeling deprived. Certified financial planners often recommend starting with “good enough” ranges rather than rigid numbers, because our brains react better to guidelines than to bans. Over the next two or three months, you can gently narrow those ranges, especially in categories that don’t strongly affect your well‑being, like impulse online shopping or duplicate streaming services.

A Practical Sequence: Budgeting for Beginners Step by Step

Below is a simple structure that many experts use when showing budgeting for beginners step by step; feel free to adjust numbers, but keep the sequence intact so your plan stays coherent:

1. Write down your average monthly income after taxes.

2. Subtract essential fixed costs (housing, utilities, minimum debt, basic transport).

3. Set a modest but automatic savings or debt‑reduction target (even 3–5% is fine at first).

4. Allocate realistic amounts for food at home, eating out, and small pleasures.

5. Leave a small “chaos buffer” for surprises, then adjust during the month.

This sequence works because it protects essentials and future‑you (through savings or debt payoff) before you decide how much to spend on flexible items. Behaviour research shows that when saving is treated as a bill you pay yourself first—rather than what’s “left over”—people are more likely to build a cushion and feel in control, even at modest income levels.

Choosing Tech or Paper: Planners, Apps and Worksheets

Once the structure is clear, you can pick a format that matches your personality. Many beginners like a lightweight personal budget planner for beginners, which might be a printed booklet with pre‑labeled categories and a calendar view; this keeps your focus on the big picture rather than on every tiny receipt. If you’re more digital‑minded, explore a few of the best budgeting apps for beginners—look for features like category customization, goal tracking, and the ability to export your data. Experts advise testing an app for at least one full month before switching, because your first week usually feels confusing while categories and rules are still being set up. If you prefer something in between, a simple budgeting worksheet for beginners to download as a PDF or spreadsheet gives structure without locking you into a particular ecosystem, and you can store it in the cloud or print it and mark it up.

Troubleshooting Common Problems Without Giving Up

Every useful budget breaks at some point; the key skill is troubleshooting, not perfection. If you constantly overspend in one category, that’s information, not failure: your plan probably underestimates either prices in your area or your actual priorities. Experts in behavioral finance suggest asking two questions: “Is this category genuinely important to my quality of life?” and “Can I trim elsewhere without real pain?” Often the answer is to increase, say, your realistic food budget and slightly reduce several low‑value items like impulse apps or décor. If you feel overwhelmed by tracking every coffee, switch to weekly check‑ins and track only big categories; accuracy might drop a little, but consistency will rise, and in practice that matters more. When a crisis hits—car repair, medical bill—temporarily move from growth mode to defense mode: pause extra debt payments or nonessential savings, keep the basics paid, and only then slowly rebuild your previous targets.

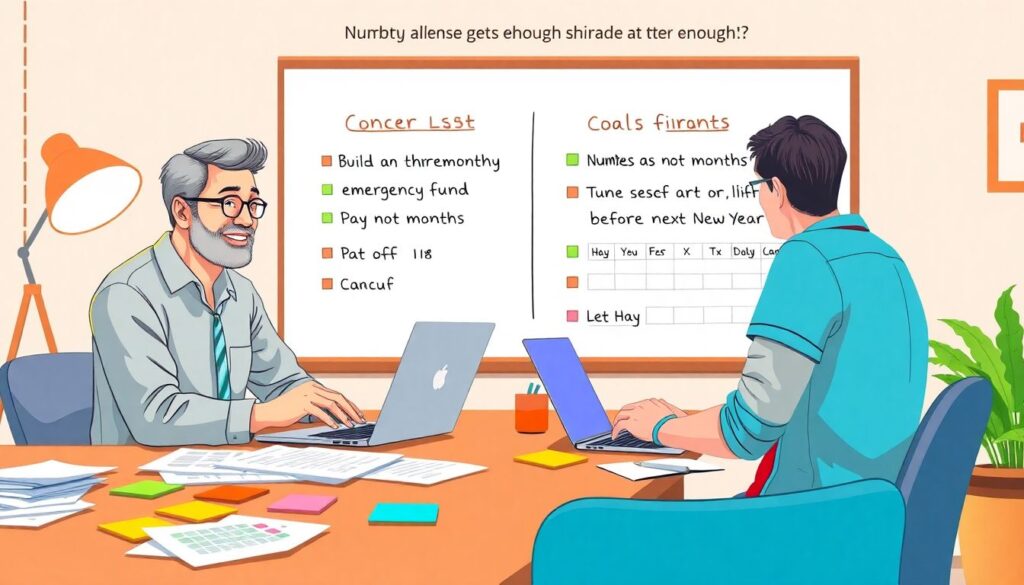

Expert Tips to Stay Motivated for the Long Run

Seasoned financial coaches often point out that numbers alone rarely keep people engaged; you need a reason behind the spreadsheet. Replace vague goals like “save more” with concrete ones such as “build a three‑month emergency fund in 18 months” or “pay off this credit card before next New Year”. Post that goal somewhere visible, or set reminders in your chosen app. Build in small rewards tied to process, not just outcomes—for example, if you log your expenses consistently for four weeks, allow a modest treat that fits inside the budget. Research on habits highlights that pairing a neutral task (checking your budget) with an existing routine (morning coffee, Sunday planning) makes it far more likely to stick. Over time, this realistic, flexible approach changes budgeting from a guilt‑ridden chore into a simple feedback loop that lets you adjust course early instead of constantly wondering where your money went.