Money From Scratch: What “Personal Financing” Really Means

Personal financing sounds like something adults in suits do in offices with glass walls. In reality, it’s just the way you decide what each unit of your income does for you. Your cash can pay bills, cushion you in emergencies, fund goals, or quietly leak away on random online orders. This beginner’s guide is about going from zero to financial basics: understanding where money comes from, where it goes, and how to nudge it in the direction of your priorities. Think of it as a light version of a personal finance for beginners course, but without homework and jargon overload. We’ll walk through tools, a simple step‑by‑step process, frequent beginner mistakes, and “troubleshooting” moves when things inevitably go off track.

Money isn’t just math here; it’s also habits, emotions, and a bit of strategy you can actually enjoy thinking about.

Why Personal Financing Matters From Day One

You might feel that real financial planning can wait until you earn more, get “a proper job,” or pay off debt. The paradox is that the smaller your income, the more every decision matters. Getting the basics right early means fewer crises and less stress later, plus you avoid learning through painful mistakes like high‑interest debt or zero savings when your laptop dies.

Tools You Actually Need (And What You Can Skip)

To handle money well, you don’t need premium software or a degree in economics; you need clarity and a few simple instruments. First, you need one place where all your numbers live: income, expenses, debts, and goals. That can be a notebook, a spreadsheet, or one of the best personal finance apps for beginners, as long as you actually use it regularly. Second, you need accounts with clear roles: a checking account for daily transactions, a savings account for your emergency fund and near‑term goals, and, later, an investment account. Third, you need a calendar or reminder system so due dates and transfers happen on time without depending on memory. Everything else, from fancy cards to complex banking products, is optional and often just noise.

Before downloading ten apps, decide which format fits your personality. If you hate typing on phones, a desktop spreadsheet may beat the trendiest app.

Apps, Spreadsheets, or Pen and Paper?

Digital tools can automate a lot, but the “best” system is one you stick to. Apps can sync bank data, send alerts, and visualize trends. Spreadsheets give you full control and transparency. A paper notebook forces you to think about each expense. Pick one, keep it simple, and resist changing systems every two weeks.

Step One: See Where Your Money Actually Goes

Most beginners jump straight to “how to start budgeting and saving money” without understanding their current reality. For at least a month, track every expense. Not “most,” not “the big ones” — every coffee, subscription, ride, and snack. The goal isn’t guilt; it’s data. When you see that “just a few deliveries” add up to a chunk of rent, your brain naturally starts adjusting behavior. You can use an app to auto‑categorize, or do it manually with categories like housing, food at home, eating out, transport, debt, fun, and random. At the end of the month, don’t judge yourself; simply ask: which categories feel aligned with my priorities and which look out of control? This honest snapshot is the foundation of any realistic plan.

A frequent rookie mistake is inventing a “fantasy budget” with numbers that ignore your real habits. Start with reality first, then gently tweak.

Step Two: Build a Starter Budget You Can Live With

A beginner budget isn’t about perfection; it’s about making sure essentials, savings, and some joy all fit. Start by listing your net income, then subtract fixed essentials (rent, basic bills, transport, minimum debt payments). Decide a small but non‑negotiable savings amount, even if it’s $20. Only then distribute what’s left to flexible categories like eating out and entertainment.

Step Three: Create an Emergency Buffer Before Anything Fancy

Before you think about investing or “making your money work for you,” you need it to protect you. An emergency fund is boring until it saves you from credit‑card debt after a medical bill or job loss. For many beginners, aiming straight for 3–6 months of expenses feels impossible, so start tiny: the first milestone is $500, then one month of must‑have costs, then gradually more. Automate this by setting up an automatic transfer on payday to a separate savings account you rarely touch. Treat that transfer like rent: not optional, just smaller at first. A classic mistake is skipping this step and putting money into long‑term investments while living one surprise away from debt. Think of the emergency fund as your financial airbag; it doesn’t make the car faster, but it keeps you alive when things go wrong.

If your income is irregular, calculate the average of the last 6–12 months and base your emergency target on that. It’s less precise, but better than guessing.

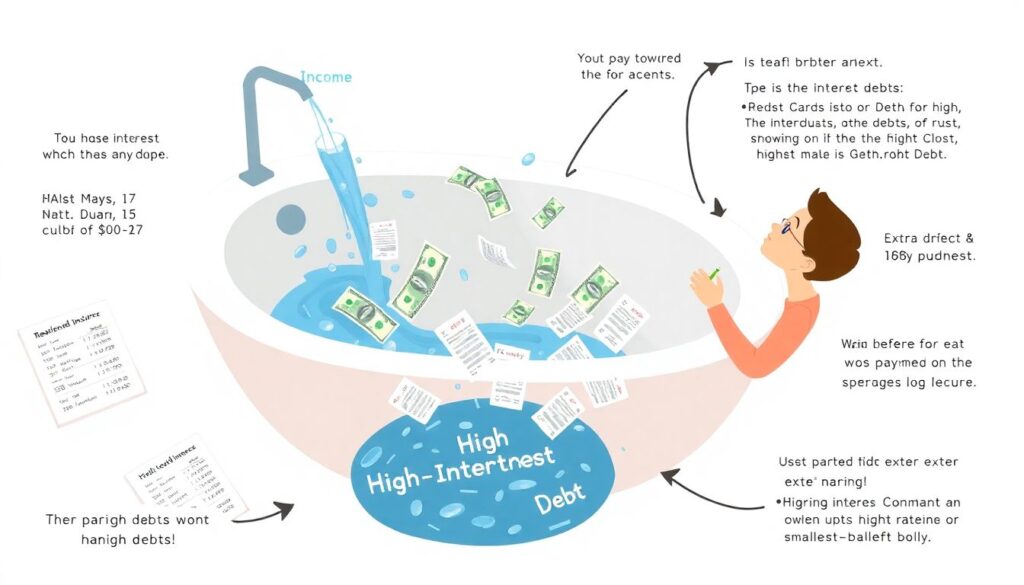

Step Four: Deal With High‑Interest Debt Strategically

Consumer debt with high interest is like trying to fill a bathtub with the drain open. List your debts, note balances and interest rates, and prioritize the most expensive ones. Pay at least the minimum on all, then put extra on the highest‑interest or smallest‑balance debt, depending on whether you value math efficiency or motivation.

Step Five: Gentle Introduction to Investing

Once you have a basic emergency fund and high‑interest debt under control, you can look at beginner investment options with low risk. For many people, that means broad index funds, simple retirement accounts offered by employers, or government‑backed bonds rather than individual stock picking or trading on emotion. Your goal at this stage is not to “beat the market,” but to get used to the idea that money can grow slowly over years. Automate small, regular contributions; this reduces the impact of market swings and removes the need to constantly decide “Is now a good time?” A common early mistake is chasing hot tips from social media, confusing speculation with investing, and putting in money you might need next year. If you’ll need the cash soon, keep it in savings, not in volatile assets, no matter how hyped the trend.

If you feel lost, consider educational resources or even a low‑cost personal finance for beginners course that focuses on principles, not quick gains.

Professional Help: When to Ask for It

You don’t need an advisor to start, but financial planning services for young adults can be useful if you have complex decisions: multiple debts, benefits at work, or big life changes. Look for fee‑only professionals who explain, not pressure. The point is guidance and structure, not someone “taking over” your money.

Common Beginner Mistakes (And How to Fix Them)

Certain traps catch almost everyone at first. One is confusing income with wealth: getting a raise and instantly raising lifestyle costs so there’s still nothing left at month’s end. Another is underestimating small, frequent purchases that quietly eat future goals. Many beginners also treat budgets as temporary punishments, so they go “all in” for a week, then burn out and quit tracking. Emotionally, guilt and shame are huge sabotage tools: one overspend day leads to “screw it, this month is ruined,” and the plan collapses. There is also the illusion of “good debt” — assuming all education or car loans are automatically wise, without checking interest rates and realistic payback. These patterns are normal, but they are not destiny. The fix lies in building systems that don’t depend on perfect willpower and in forgiving slip‑ups while still learning from them.

Try thinking in terms of experiments: “For the next 30 days, I’ll test this budget and learn,” instead of “From now on, I must be perfect with money.”

How to Start Budgeting and Saving Money Without Feeling Broke

Shift from “I can’t buy this” to “If I buy this, I’m choosing it over something else.” Name your savings goals: emergency, travel, new laptop. It’s easier to skip random spending when you know exactly what that money could do for Future You.

Troubleshooting Your Money Plan When It Stops Working

Even the best‑designed plan will sometimes fail in the wild. Troubleshooting personal financing starts with diagnosis, not self‑criticism. Ask three questions: Did I underestimate actual costs? Did something unexpected happen? Or did emotions and habits override my system? If your budget is constantly blown in the same category — say, food delivery — it’s not a moral failing; it’s a sign that your plan doesn’t match your real life. Adjust the numbers rather than pretending next month will magically be different. If irregular income derails you, switch to a “bare‑bones” baseline budget you can always cover, and treat extra income as bonuses for debt, savings, or big goals. When you hit a setback, avoid the “reset next month” trap. Instead, do a mid‑month micro‑reset: recalc how much remains and update the plan for the rest of the period. Small course corrections beat dramatic restarts.

If you keep repeating the same mistake, write a tiny rule for yourself, like “No online shopping after 10 p.m.” or “Wait 24 hours before non‑essential buys.” Simple constraints can protect you from your tired brain.

When Your Motivation Disappears

Boredom and fatigue are normal. To keep going, make progress visible: track net worth, savings milestones, or debt shrinking. Celebrate small wins cheaply — a walk, a home movie night. Your goal isn’t constant motivation; it’s a routine that keeps working even when you don’t feel inspired.

Bringing It All Together

Personal financing from zero doesn’t require perfection, big income, or a talent for numbers. It requires seeing the truth of your current situation, making a simple plan, and being kind but honest with yourself as you adjust. Start with tracking, build a budget you can actually live with, protect yourself via an emergency fund, tame high‑interest debt, and only then move on to simple investing. Use tools that fit your habits, whether that’s spreadsheets, notebooks, or the best personal finance apps for beginners, and don’t hesitate to learn from books, podcasts, or a good personal finance for beginners course if you like structure. The real skill isn’t never making mistakes; it’s learning to spot and fix them before they snowball. Step by step, you’ll move from reacting to money crises to quietly, steadily directing your financial life on your own terms.