What Is Budgeting, Really?

Let’s start with the basics. Budgeting is simply the act of creating a plan for how you’ll spend your money. This plan is called a budget. It helps you ensure you have enough for the things you need, while also helping you avoid unnecessary debt or overspending. Think of it like GPS for your finances—it tells your money where to go instead of wondering where it went. Unlike just tracking expenses, budgeting is proactive. It’s about assigning every dollar a job before it’s spent.

Why Budgeting Beats “Winging It”

Some folks think budgeting is restrictive, but the opposite is true. It gives you control. Without a budget, it’s easy to fall into the trap of living paycheck to paycheck. With a clear spending plan, you can prioritize savings, pay off debt faster, and even plan for fun—like vacations or new gadgets. Imagine two people earning the same income: one budgets, the other doesn’t. After a year, the budgeter likely has savings, while the other might be stuck in a cycle of overdraft fees and credit card debt. That’s the power of planning.

Step-by-Step: Building Your First Budget

Creating your first budget doesn’t require advanced math—just honesty and consistency. Start by listing your monthly income. Include your salary, freelance gigs, and any passive income. Then, list your expenses. Break them into two categories: fixed (like rent and car payments) and variable (groceries, entertainment, etc.). Subtract your total expenses from your income. If the result is negative, you’re overspending and need to adjust. If it’s positive, allocate the surplus to savings or debt repayment. Pro tip: use the 50/30/20 rule as a starting point—50% for needs, 30% for wants, 20% for savings and debt.

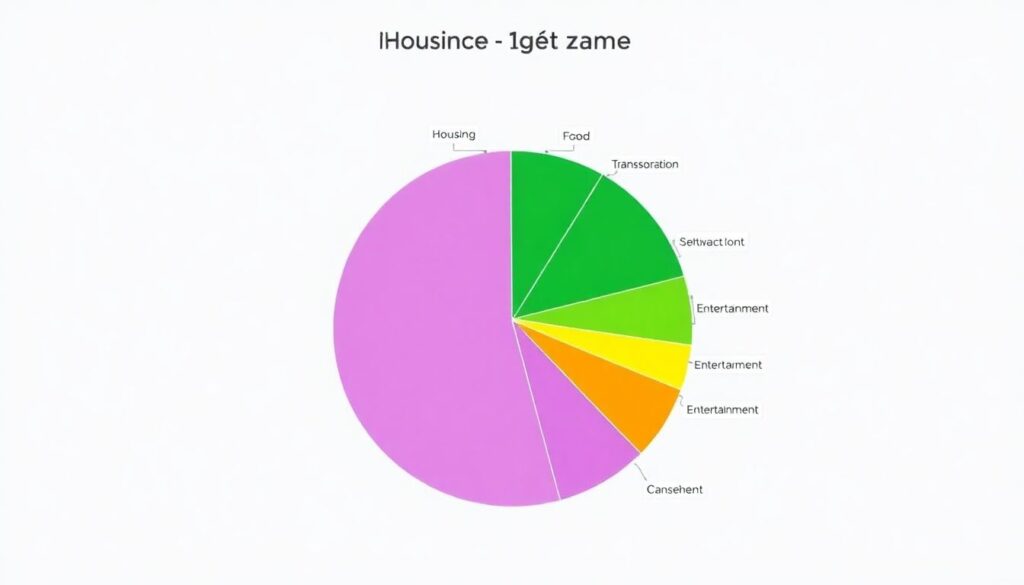

Visualizing Your Budget

To better understand where your money’s going, imagine a pie chart. Each slice represents a category: housing, food, transportation, entertainment, and so on. If housing takes up half the pie, that’s a sign to reconsider your rent or mortgage. Budgeting apps like YNAB or Mint can generate these diagrams automatically. But even a hand-drawn chart can make a big difference. Seeing your spending in a visual format often reveals patterns you might miss in a spreadsheet.

Cash-Only vs. Digital Apps: What Works Best?

There’s no one-size-fits-all approach to budgeting. Some people swear by the envelope system—allocating cash to physical envelopes labeled “groceries,” “gas,” etc. When the envelope’s empty, you’re done spending. It’s tactile and simple, ideal for those who struggle with overspending. Others prefer digital tools that link to bank accounts and track spending in real-time. Apps like EveryDollar focus on zero-based budgeting, while Goodbudget is a digital take on the envelope method. Try both and see what sticks.

Common Pitfalls and How to Avoid Them

One rookie mistake is forgetting irregular expenses—like annual subscriptions, car maintenance, or holiday gifts. These sneak up if you don’t plan ahead. To stay prepared, create a “sinking fund,” where you set aside small amounts monthly for future big-ticket costs. Another trap is unrealistic expectations. Don’t cut your food budget in half overnight. Small, sustainable changes work better. Lastly, avoid comparing your budget to others’. Your priorities are unique. Focus on progress, not perfection.

Real-Life Example: Anna’s Budgeting Breakthrough

Take Anna, a 29-year-old graphic designer. She used to spend impulsively, especially on food delivery and clothes. After tracking her expenses for a month, she realized she was spending $400 on takeout alone. She set a realistic goal to cut that in half and started meal prepping. She also funneled the extra $200 into her emergency fund. Within six months, she saved $1,200 without feeling deprived. Her key takeaway? Budgeting gave her freedom, not restrictions.

It’s Not Just About Saving—It’s About Goals

Budgeting isn’t just about pinching pennies. It’s about aligning your spending with your values. Want to travel more? Save for a home? Retire early? Your budget is the roadmap to get there. Set short-term and long-term goals, then adjust your spending accordingly. If your goal is to save $5,000 in a year, that’s about $417 per month. Knowing the “why” behind your budget makes it easier to stick with when temptation strikes.

Automation: Your Budget’s Best Friend

Let’s be honest—life gets busy. That’s where automation comes in. Set up automatic transfers to savings on payday. Schedule bill payments to avoid late fees. Use alerts on your phone to warn you when you’re nearing your spending limits. Automation reduces the willpower required to stay on track. It also makes budgeting feel less like a chore and more like a smart system running in the background.

Final Thoughts: Start Small, Stay Consistent

You don’t need to overhaul your entire financial life overnight. Start by tracking your spending for a week. Then build a simple monthly budget. Adjust as you go. The key is consistency. Budgeting isn’t a one-time event—it’s a habit. And like any habit, it gets easier with practice. Over time, you’ll notice the benefits: less stress, more savings, and clearer financial direction. That’s the foundation of a bright financial future.