Historical Context: The Evolution of Financial Statements

Understanding financial statements in 2025 requires a brief journey through their historical trajectory. Financial reporting, as a concept, took shape during the late 19th and early 20th centuries with the rise of industrial capitalism. The increasing complexity of business operations demanded standardized ways to communicate financial health. The Great Depression of the 1930s marked a turning point, leading to the establishment of regulatory bodies like the U.S. Securities and Exchange Commission (SEC), which mandated financial disclosures. Over the decades, frameworks such as Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) emerged, shaping the modern structure of financial statements. In today’s digital economy, these documents not only serve regulatory and investor needs but also fuel analytics in fintech, corporate governance, and AI-driven decision-making.

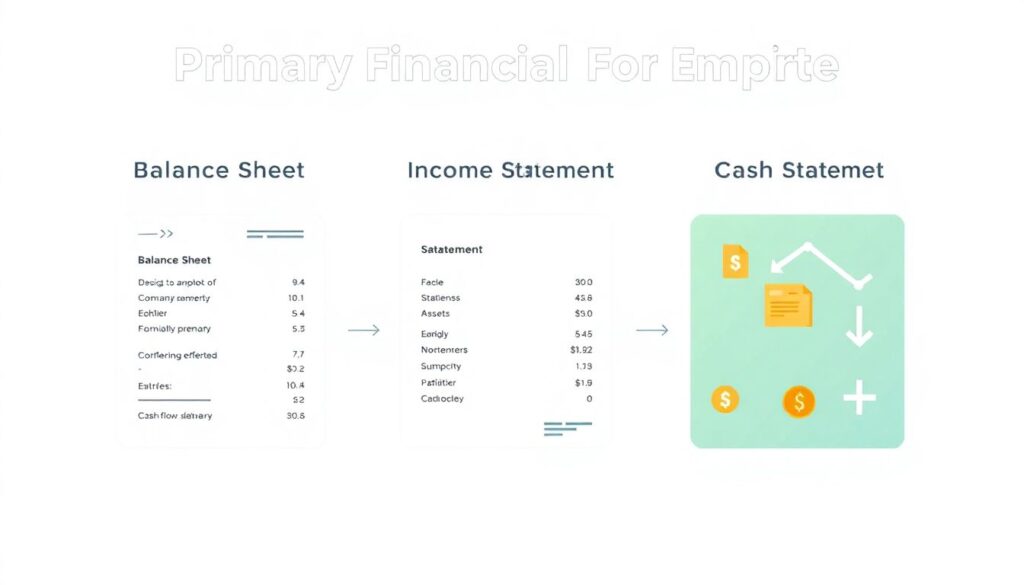

Core Components: Decoding the Three Pillars

For beginners, the three primary financial statements—Balance Sheet, Income Statement, and Cash Flow Statement—can seem daunting. However, each serves a distinct purpose in evaluating a company’s financial health. The Balance Sheet provides a snapshot of a firm’s assets, liabilities, and equity at a specific moment, reflecting its solvency. The Income Statement details revenues and expenses over a period, illustrating profitability. Meanwhile, the Cash Flow Statement tracks the inflows and outflows of cash, offering insights into liquidity and operational efficiency. In 2025, companies increasingly integrate real-time data analytics into these statements, allowing for continuous monitoring rather than quarterly snapshots. Understanding how these documents interrelate is vital for stakeholders aiming to assess risk, return, and operational sustainability.

Statistical Insights: The Financial Literacy Gap

Despite advances in technology and education, financial illiteracy remains prevalent. According to a 2024 OECD study, only 33% of adults globally could correctly interpret fundamental financial statements. Among millennials and Gen Z, the most digitally native groups, less than 40% understood the implications of cash flow issues or balance sheet leverage. In an era where retail investing, gig economy participation, and side hustles are on the rise, this gap poses severe economic implications. With platforms like Robinhood and eToro democratizing investment, the absence of basic financial comprehension can lead to misinformed decisions and financial instability. Bridging this gap through both formal education and user-friendly tools is a pressing necessity.

Economic Implications of Financial Misunderstanding

A lack of understanding of financial statements doesn’t just affect individual investors—it has macroeconomic reverberations. Small and medium-sized enterprises (SMEs), which constitute over 90% of global businesses, often mismanage resources due to poor financial literacy. The result is suboptimal capital allocation, missed investment opportunities, and heightened default rates. The World Bank estimates that over 70% of SME bankruptcies in emerging markets are linked to improper financial planning. When business leaders misinterpret financial signals, they may continue unsustainable operations or fail to capitalize on growth windows. This ripple effect can suppress job creation, innovation, and GDP contributions, highlighting the systemic importance of financial education.

Forecasting Future Trends in Financial Reporting

Looking ahead, financial statements are poised to undergo transformative shifts by 2030. The integration of artificial intelligence will automate much of the reporting process, reducing human error and increasing transparency. ESG (Environmental, Social, Governance) metrics are being embedded into standard financial disclosures, reflecting stakeholder demand for broader accountability. Moreover, decentralized finance (DeFi) platforms are beginning to experiment with blockchain-based financial statements, promising real-time validation and immutability of data. For beginners, this means that while the core concepts of financial understanding remain, the tools and mediums of learning will evolve rapidly. Institutions that adapt early to these trends will likely see improved investor confidence, efficient capital markets, and enhanced long-term resilience.

Industry-Wide Impact and Strategic Importance

From banking to healthcare, every sector relies on financial statements not merely for compliance but for strategic positioning. In the tech industry, where intangible assets dominate, financial statements are increasingly supplemented by key performance indicators (KPIs) tailored to digital ecosystems. Meanwhile, in manufacturing and retail, inventory turnover and cost accounting metrics derived from financial statements inform critical supply chain decisions. As of 2025, over 85% of Fortune 500 companies use advanced financial dashboards powered by AI to visualize statement data for strategic insights. For beginners, recognizing that financial statements are not static reports but dynamic strategic tools is essential to understanding their true value in modern industry.

Conclusion: Building a Foundation for Financial Empowerment

In a world characterized by economic volatility, digital disruption, and increasing financial autonomy, understanding financial statements is no longer the domain of accountants alone. It is a foundational skill for entrepreneurs, employees, and investors alike. While the documents themselves have long-standing formats, their interpretation now integrates technology, real-time analytics, and industry-specific nuances. As beginners build their financial acumen, the benefits are multifold: from smarter personal finance decisions to more sustainable business practices. The historical roots of financial reporting remind us that these tools evolved to bring transparency and trust—principles that remain just as relevant in 2025 as they did a century ago.