Understanding Financial Essentials and Discretionary Spending

Defining Financial Essentials

In personal finance, essential expenses refer to non-discretionary costs that are necessary for a basic standard of living. These typically include housing (rent or mortgage), utilities, food, transportation, healthcare, and minimum debt payments. In contrast, discretionary spending encompasses non-essential purchases such as dining out, entertainment subscriptions, travel, and luxury items. The distinction is critical when developing a savings strategy that preserves quality of life while optimizing cash flow.

To visualize this, imagine a pie chart where essential costs occupy approximately 50–60% of net income for the average household in 2025. This proportion varies based on geographic location, income level, and lifestyle. For instance, in urban centers with high living costs, housing alone can consume 40% of income, whereas in suburban or rural areas, this may drop to 25%, freeing up resources for savings or discretionary use.

The Role of Fixed vs. Variable Costs

Another classification relevant to savings strategies is the division between fixed and variable expenses. Fixed costs remain constant month-to-month (e.g., rent, insurance premiums), while variable costs fluctuate (e.g., grocery bills, fuel consumption). Saving more without cutting essentials involves targeting variable expenses for optimization through behavioral adjustments and technology-driven solutions. For example, using AI-based grocery planning apps can reduce food waste and lower monthly grocery bills by up to 15% without impacting nutritional intake.

Leveraging Technology for Automated Savings

Modern Budgeting Tools and AI Integration

In 2025, the integration of artificial intelligence in personal finance applications has transformed how beginners can manage money. Platforms such as YNAB (You Need a Budget), Monarch Money, and newer AI-native apps like FinScope utilize machine learning to analyze spending patterns and recommend personalized savings strategies. These tools automatically categorize transactions, identify redundant subscriptions, and simulate future financial scenarios based on user-defined goals.

A comparative analysis shows that traditional spreadsheets require manual data entry and lack real-time insights, while AI-powered platforms provide dynamic feedback. For instance, FinScope can alert users when their discretionary spending exceeds historical averages and suggest micro-adjustments, such as shifting from premium coffee brands to cost-efficient alternatives, without sacrificing daily routines.

Round-Up and Micro-Saving Features

Round-up saving mechanisms, increasingly popular in 2025, automatically allocate spare change from transactions into savings or investment accounts. For example, if a user spends $4.60 on coffee, the system rounds up to $5.00 and transfers $0.40 to a savings account. Over time, these micro-savings accumulate significantly. Some platforms enhance this by offering rule-based savings, where users set conditions like “save $2 every time I skip a ride-share” or “transfer $10 when I cook at home.”

Unlike traditional savings models that require conscious deposits, these automated systems reduce psychological resistance and leverage behavioral economics principles—specifically, the nudge theory, which encourages beneficial choices without restricting freedom.

Subscription Auditing and Smart Consumption

Subscription Management in a Digital Economy

The average consumer in 2025 subscribes to 7–10 digital services, ranging from video streaming to cloud storage and fitness apps. While each service may cost under $20/month, cumulatively, they can exceed $200 monthly. Subscription auditing tools like Truebill and Rocket Money use AI to detect overlapping or underutilized services and suggest cancellations or downgrades.

For example, if a user holds both Spotify and YouTube Premium for ad-free music and video, the system may recommend consolidating with a bundled Google One plan that covers both functionalities at a lower price. This approach preserves the service quality while reducing redundant expenditure.

Energy Efficiency and Consumption Analytics

Smart home technologies have enabled users to monitor and reduce energy consumption without compromising comfort. Devices like Nest thermostats and Sense energy monitors provide real-time feedback on electricity usage. These tools use predictive algorithms to adjust heating and cooling based on occupancy patterns, potentially reducing utility bills by 20–30% annually.

Compared to manual thermostat programming, AI-driven systems adapt dynamically to user behavior and external weather data. This ensures that savings are achieved not by lowering heating or cooling standards but by eliminating inefficiencies, like heating unoccupied rooms or running appliances during peak tariff hours.

Behavioral Adjustments Without Sacrifice

Meal Planning and Grocery Optimization

Grocery spending remains a significant variable expense. In 2025, AI-enhanced meal planning apps like Whisk and Cooklist use historical purchase data, dietary preferences, and local store pricing to generate cost-effective shopping lists. These platforms also integrate with smart fridges to track expiration dates and reduce food waste.

Rather than cutting back on food quality or quantity, users can shift to cost-optimized meal structures, such as batch cooking and ingredient reuse. For instance, a chicken roast can serve as the base for multiple meals—salads, sandwiches, and soups—reducing per-meal costs while maintaining nutritional standards.

Transportation Alternatives and Mobility Trends

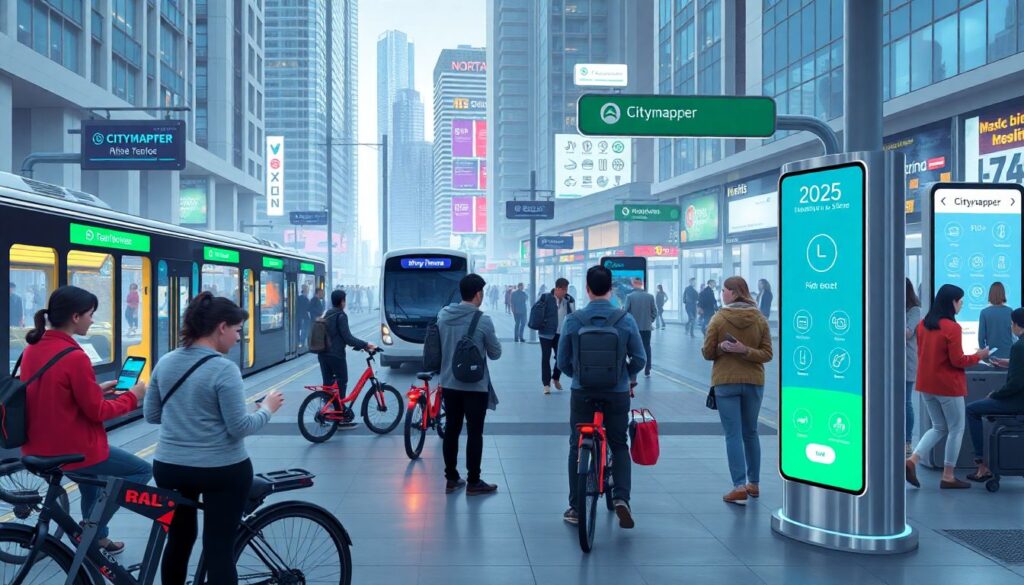

With the rise of Mobility-as-a-Service (MaaS) platforms in 2025, urban dwellers increasingly opt for multimodal transport solutions instead of car ownership. Apps like Citymapper and Moovit integrate public transport, e-bike rentals, and ride-shares into unified payment systems. Monthly MaaS subscriptions often cost 40–60% less than maintaining a personal vehicle, including insurance, fuel, and maintenance.

For example, replacing a $600/month car expense with a $250 MaaS plan yields $4,200 in annual savings without sacrificing mobility. Furthermore, MaaS platforms offer carbon tracking and rewards for eco-friendly choices, aligning financial savings with sustainability goals.

Conclusion: Sustainable Saving Through Optimization

Saving more in 2025 without cutting essentials is no longer a paradox but a function of technological leverage, behavioral economics, and data-driven decision-making. By targeting variable costs, utilizing AI-powered tools, and adopting smart consumption habits, beginners can enhance their financial resilience without compromising their standard of living. The emphasis shifts from restriction to optimization—achieving savings through efficiency rather than deprivation. As digital finance ecosystems mature, the ability to automate and personalize savings strategies will become increasingly accessible, empowering users to meet long-term goals with minimal friction.