Mastering Budgeting Basics: A Starter Guide for Beginners

Why Budgeting Matters More Than You Think

Managing personal finances may seem intimidating at first, but learning to budget is one of the most powerful tools for achieving financial stability. Whether you’re saving for a vacation, paying off debt, or simply trying to stop living paycheck to paycheck, a solid budget is the foundation you need. This guide is designed to equip beginners with practical knowledge—along with insight into common mistakes that often derail budgeting efforts.

Essential Tools for Effective Budgeting

Before diving into the process, it’s crucial to have the right tools at your disposal. Fortunately, you don’t need complicated software or expensive subscriptions. Most tools are either free or low-cost and easy to use.

- Spreadsheets: Programs like Microsoft Excel and Google Sheets offer customizable templates. They’re ideal for tracking income, expenses, and savings goals manually.

- Budgeting Apps: Apps like YNAB (You Need A Budget), Mint, and PocketGuard connect directly to your bank account and automate much of the process.

- Pen and Paper: For those who prefer tactile methods, a journal or notebook can serve as a budget tracker—simple but effective.

Each method has its own strengths. Choose one that aligns with your habits and comfort level.

The Step-by-Step Budgeting Process

1. Calculate Your Net Income

Start by identifying how much money you actually bring home each month—after taxes and deductions. This is your net income and the baseline for your budget. Many beginners overlook deductions and end up budgeting based on gross income, which inevitably leads to overspending.

2. Track Your Expenses

Spend at least a month monitoring where your money goes. Break down your expenses into categories: housing, food, transportation, subscriptions, entertainment, and savings. Be honest and include even the smallest purchases like coffee or digital rentals—those add up quickly.

3. Set Clear Financial Goals

Your goals give your budget direction. Are you aiming to build an emergency fund, pay off credit card debt, or save for a car? Define your short-term and long-term objectives. This helps you prioritize spending and make intentional choices.

4. Create a Realistic Spending Plan

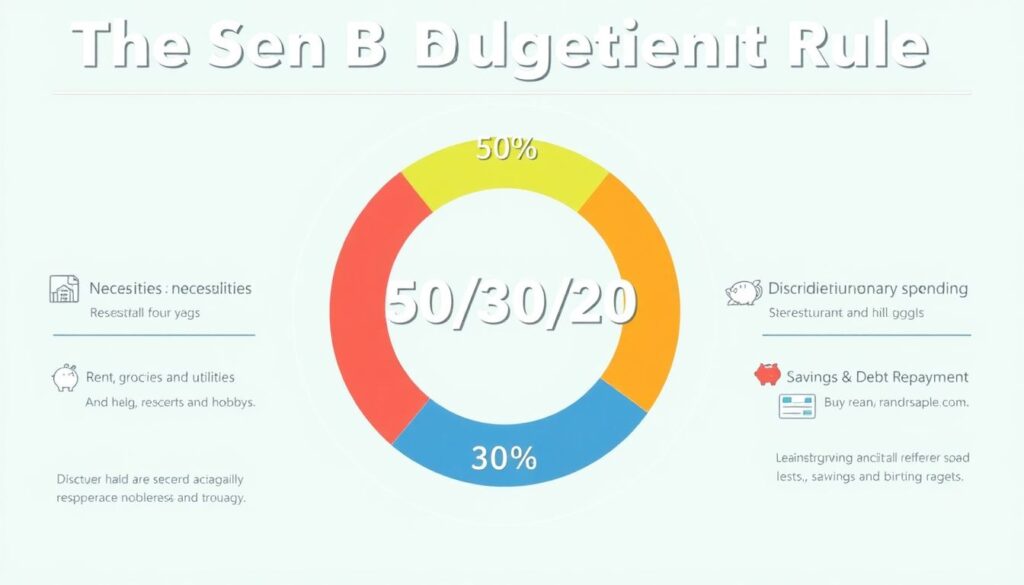

Using your income and expense data, allocate specific amounts to each spending category. A popular rule of thumb is the 50/30/20 method:

– 50% of income for necessities (rent, groceries, utilities)

– 30% for discretionary spending (restaurants, hobbies)

– 20% for savings and debt repayment

Adapt this rule according to your personal circumstances.

5. Monitor and Adjust Regularly

Your budget isn’t static. Life changes—so should your financial plan. At the end of each month, review your progress. Did you overspend in one category? Did your income change? Small, consistent adjustments help you stay on track.

Common Mistakes to Avoid

Even with the right tools and process, many beginners fall into predictable traps. Recognizing these pitfalls early can save time, money, and frustration.

- Underestimating Expenses: Many people forget irregular costs like annual subscriptions, gifts, or car maintenance. Build a buffer to accommodate the unexpected.

- Being Too Restrictive: Cutting all personal spending can backfire. Budgeting isn’t punishment—it’s planning. Allow room for occasional indulgences to avoid burnout.

- Ignoring Small Transactions: Micro-purchases—like daily coffee or streaming rentals—may seem trivial, but they erode your budget if left unchecked.

Another common oversight is failing to include savings as a fixed “expense.” Pay yourself first—automate savings contributions as if they were bills.

Troubleshooting Budgeting Roadblocks

Even a solid strategy may encounter setbacks. The key is not to abandon your budget but to troubleshoot wisely.

Income Fluctuations

Freelancers and gig workers often face irregular income. In this case, base your budget on your lowest monthly earnings. Use higher-income months to build a reserve that cushions lean periods.

Overspending Patterns

Frequent overspending in one category (e.g., dining out) signals a need for either behavioral change or budget reallocation. Analyze the triggers—are they social pressures, time constraints, or emotional spending?

Budget Fatigue

Tracking every penny can become exhausting. If you’re burning out, simplify: use broader categories or switch to an app that automates tracking. The goal is sustainability over precision.

Final Thoughts

Mastering the basics of budgeting isn’t about creating a perfect plan—it’s about forming mindful habits that evolve with your life. Start where you are, use tools that make sense for you, and don’t be afraid to revise your approach. Mistakes are inevitable, but with each adjustment, you’re getting closer to financial clarity and control.