Your First Personal Budget: A Step-by-Step Tutorial

Budgeting: A Brief Look Back

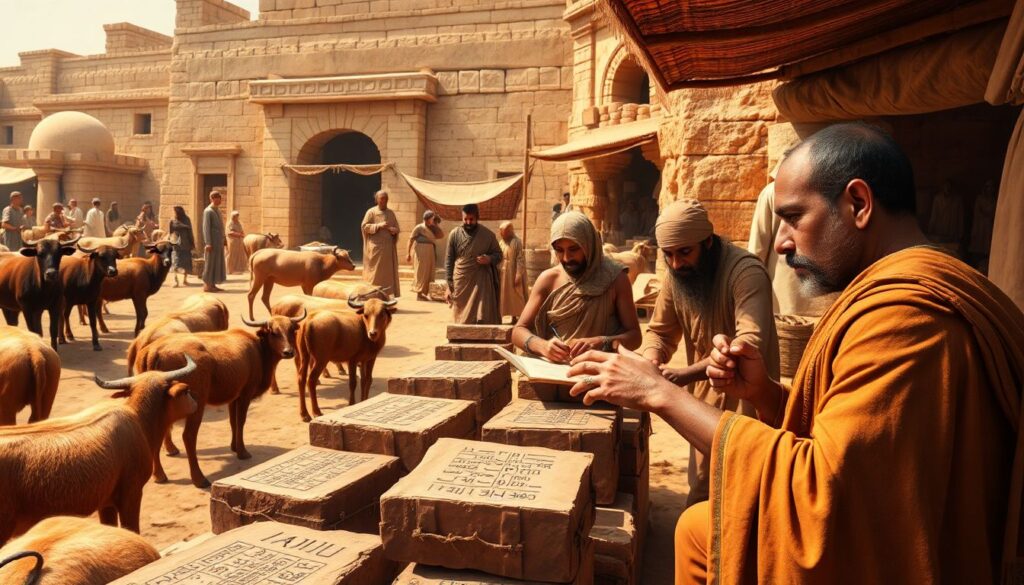

Before we dive into the practical steps of creating your very first personal budget, let’s take a quick detour into history. Although budgeting might seem like a modern concept shaped by smartphone apps and subscription services, managing money actually dates back thousands of years.

In ancient Mesopotamia, around 3,000 BCE, merchants and farmers recorded transactions on clay tablets — an early form of financial tracking. Fast forward to the 20th century, budgeting became a household practice during the Great Depression of the 1930s. Families were forced to track every penny, redefining personal finance as a survival skill. By the 1980s and 90s, paper checkbooks and spreadsheets ruled the game. And now, in 2025, budgeting tools are smarter than ever — driven by AI, real-time analytics, and personalized financial coaching. But regardless of the tools, the core principles remain timeless.

Understanding the Basics: Why Budgeting Matters

Creating a budget isn’t about limiting yourself — it’s about giving your money a job. When you know where every dollar is going, you’re in control. Whether you’re saving for a vacation, paying off student loans, or just trying to stop living paycheck to paycheck, a personal budget is your foundation.

At its heart, budgeting is simply this: tracking your income, planning your expenses, and adjusting your behavior to meet financial goals. It’s not complicated — but it does take commitment.

Step-by-Step: Building Your First Budget

Here’s a straightforward roadmap for building your first budget from scratch:

- Calculate Your Monthly Income

Start with your take-home pay — the amount you actually receive after taxes and deductions. If you’re a freelancer or contractor, use an average from the last three to six months. - List All Your Expenses

Break them into two types: fixed (like rent, subscriptions, car payments) and variable (like groceries, gas, entertainment). Don’t forget the sneaky ones — gifts, annual renewals, or occasional dining splurges. - Set Spending Limits

Based on your income and priorities, assign a dollar limit to each category. This isn’t about perfection. Think of it as a living document that evolves with your life. - Track Everything

Use whatever works for you — a budgeting app like YNAB or Monarch, a spreadsheet, or even a notebook. The key is consistency. Record purchases as they happen or at the end of each day. - Review and Adjust

At the end of the month, sit down and compare your actual spending to your plan. Over on takeout? Adjust the next month. Under on groceries? Great — roll it into savings.

Real-Life Example: Meet Alex

Let’s say Alex, 27, just landed his first full-time job in marketing and earns $3,500 per month after taxes. He lives in a shared apartment, pays $1,200 for rent, and has $400 in student loan payments. Here’s what his first budget might look like:

– Rent: $1,200

– Student Loans: $400

– Groceries: $300

– Transportation: $150

– Subscriptions & Entertainment: $200

– Savings: $400

– Miscellaneous: $100

– Emergency Fund: $750 (initial goal over 6 months)

By tracking his spending and tweaking as he goes, Alex starts saving for emergencies and avoids overdraft fees. Within six months, he’s built a $2,500 emergency cushion and is ready to start investing.

Common Budgeting Myths That Trip People Up

There are a lot of misconceptions floating around that can stop people from even starting. Let’s bust a few of them.

- “Budgeting is only for people who are bad with money.”

Actually, it’s the opposite. The most financially successful people track their money carefully. Budgeting is a smart habit, not a punishment. - “I don’t make enough to budget.”

Whether you make $500 or $5,000 a month, knowing where your money goes can help you make the most of it. Every dollar counts even more when your income is tight. - “Budgets are rigid and boring.”

Nope. A good budget is flexible. It changes with you. And honestly, watching your savings grow or finally affording that trip to Japan is anything but boring. - “I’ll remember everything — I don’t need to write it down.”

Memory is unreliable. Logging your expenses helps you see patterns and plug leaks. Think of it like tracking your workouts — you can’t improve what you don’t measure.

The Bottom Line

Your first personal budget might feel awkward — like learning to ride a bike. Expect to stumble a bit. But stick with it. In 2025, with inflation, digital subscriptions multiplying, and economic uncertainties still lingering, financial awareness is more important than ever.

And here’s the good news: you don’t need to be a math genius or a finance nerd to succeed. Just start. One paycheck at a time — and you’ll be surprised how quickly budgeting becomes second nature.